You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread The 3 Duck's Trading System

- Thread starter Captain Currency

- Start date

- Watchers 259

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

davechilde

Member

- Messages

- 88

- Likes

- 1

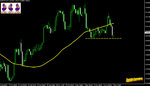

A move below the 240m low would really get me interested in looking for selling ops on Usd.Cad. Bears would be back in control and price would be moving in the direction of the longer term down trend once again.

I agree, already got my line drawn for entry below 1.0600

blancspa

Established member

- Messages

- 814

- Likes

- 35

I agree, already got my line drawn for entry below 1.0600

Can I be more agressive and try to sell at 1.0607?

Another thing is: the pair had already moved 140 pips today? what would be the Target?

davechilde

Member

- Messages

- 88

- Likes

- 1

Can I be more agressive and try to sell at 1.0607?

Another thing is: the pair had already moved 140 pips today? what would be the Target?

Personally I don't see me entering today, as you say it's already moved 140 and a push lower now, could easily be followed by a pullback. I'd be happier to see it consolidate today between 1.0600 and 1.0650 and look to enter on a fresh move down after that.

I also think it will need to move at least 20 or 30 pips under 1.0600 to confirm the break and ressumption of the longer term downtrend noted by Captain Currency. 1.0600 has been tested 8 times in the last week on the 4H chart and has bounced on each occasion.

davechilde

Member

- Messages

- 88

- Likes

- 1

Well, as much I would have rather seen a longer period of consolidation, who am I to argue with the market. It's shown a fairly firm push below 1.0600, so I've taken a small short at 1.0575.

davechilde

Member

- Messages

- 88

- Likes

- 1

Unless you were looking to scalp I'd say it doesn't have to be an oppertunity missed( IMHO of course). if you look at the daily chart (not a 3 ducks time frame, I know) the sell offs for this pair for this year since it peaked at over 1.300 in early March have been pretty deep sell offs lasting 10 days or more, indeed the last one in early October sold off from circa 1.083 to 1.024 in 9 trading days, that's 590 pips!

Also the 1.060 broken today, is not just a key level from the last week or so, if you look again at the daily, the pair tested this level in April and September,crashed through it in October, before it briefly pulled back above the 60SMA (daily), which it is now again comfortably below.

Also the 1.060 broken today, is not just a key level from the last week or so, if you look again at the daily, the pair tested this level in April and September,crashed through it in October, before it briefly pulled back above the 60SMA (daily), which it is now again comfortably below.

Apologies for missing the UC short but I was recovering from minor surgery.

Being on the other side of the world would have made this one easy pickings.

I shall have to bill my surgeon for an inconvenient appointment. 🙂

In retrospect I would have taken it from 1.0720 as starter with reinforcement at 1.0610 once the prior H1 low was taken out. I am not too sure that 3D always profits by waiting for that low to confirm. I am tending to watch the H1 EMA 5/12 cross particularly on the short side which is almost always quicker.

Being on the other side of the world would have made this one easy pickings.

I shall have to bill my surgeon for an inconvenient appointment. 🙂

In retrospect I would have taken it from 1.0720 as starter with reinforcement at 1.0610 once the prior H1 low was taken out. I am not too sure that 3D always profits by waiting for that low to confirm. I am tending to watch the H1 EMA 5/12 cross particularly on the short side which is almost always quicker.

davechilde

Member

- Messages

- 88

- Likes

- 1

looks as though the 1.0600 support that was broken yesterday is now providing resistance to a push back up today.

Took a short on a 3 Ducks trade on USD/CHF earlier today when it passed the previous low of 1.007, but now closed it for a 30 pip loss. On reflection, should have closed it sooner when it pushed fairly firmly through the 60SMA an hour ago.

Also been watching Gold with 3 Ducks in mind. It has been following the steady upward trend in the 1H 60SMA since it crossed it on 29 Oct. It came down to touch the 60SMA yesterday and took a bounce of it today, so I took a long entry from the 5M chart when it crossed 1101 this morning after the last high at that level from 7.00am today. Target for this trade is somewhere around the last high in the 4H at 1109.

Took a short on a 3 Ducks trade on USD/CHF earlier today when it passed the previous low of 1.007, but now closed it for a 30 pip loss. On reflection, should have closed it sooner when it pushed fairly firmly through the 60SMA an hour ago.

Also been watching Gold with 3 Ducks in mind. It has been following the steady upward trend in the 1H 60SMA since it crossed it on 29 Oct. It came down to touch the 60SMA yesterday and took a bounce of it today, so I took a long entry from the 5M chart when it crossed 1101 this morning after the last high at that level from 7.00am today. Target for this trade is somewhere around the last high in the 4H at 1109.

cambridgedon

Active member

- Messages

- 161

- Likes

- 2

Davechilde,

Went short this morning @ 10576 and had a trailing stop hit later for 14 pips. Over the two days I have given back 70% of profits on winning trades. Can't seem to get the balence right between giving winners room and losing profit on big retracements.

On gold, I see what you mean but the R/R looks too small. Hope you do OK with it.

Ray

Went short this morning @ 10576 and had a trailing stop hit later for 14 pips. Over the two days I have given back 70% of profits on winning trades. Can't seem to get the balence right between giving winners room and losing profit on big retracements.

On gold, I see what you mean but the R/R looks too small. Hope you do OK with it.

Ray

davechilde

Member

- Messages

- 88

- Likes

- 1

For USD/CAD whilst I'm not a fan of holding trades overnight, I was confident that a push below 1.0600 would see a decent sell off. I wouldn't be surprised if it dropped 400 or 500 pips, which is why I have set a much wider stop than i normally would and wasn't fazed when it came back to touch 1.0600 yesterday, as long as it didn't breach it. Although I suspect it will go further, due to my reticence to hold overnight, if it has a decent dip today, i'll take, say 150 pips, and run rather than risk a retracement.

For Gold I'm not sure I agree with you. I entered at 1101, I would have treated the last low of 1097 as the stop so that's 40 pips. A sensible target of 1109 gives 80 so thats 1:2 R/R. in any event I saw it hit 1109 briefly in the 3pm (GMT) bar so took 70 pips at 1108, even though I think there's a decent chance of making a new high past Monday's 1111.30.

Just taken a long on Cable as it passed the last high of 1.6732 from 6.00am, but suspect I may have been a bit trigger happy as it is now pulling back, although holding above the 5M 60SMA. It seems to have spent most of yesterday trying to recover from the early sell off in the 1H but without too much strength so I'm going to be strict with a stop at the 6.05 (GMT) low of 1.6714.

Dave

For Gold I'm not sure I agree with you. I entered at 1101, I would have treated the last low of 1097 as the stop so that's 40 pips. A sensible target of 1109 gives 80 so thats 1:2 R/R. in any event I saw it hit 1109 briefly in the 3pm (GMT) bar so took 70 pips at 1108, even though I think there's a decent chance of making a new high past Monday's 1111.30.

Just taken a long on Cable as it passed the last high of 1.6732 from 6.00am, but suspect I may have been a bit trigger happy as it is now pulling back, although holding above the 5M 60SMA. It seems to have spent most of yesterday trying to recover from the early sell off in the 1H but without too much strength so I'm going to be strict with a stop at the 6.05 (GMT) low of 1.6714.

Dave

davechilde

Member

- Messages

- 88

- Likes

- 1

...which it hit about 30 seconds after sending this post....

HawkTrader

Established member

- Messages

- 620

- Likes

- 130

😆

Welcome to trading.

Welcome to trading.

davechilde

Member

- Messages

- 88

- Likes

- 1

I've seen cable regularly start a move around 7am only to retrace to the recent low before setting off again. I set my stop tight at the 6.05am low because I wasn't sure the move had much strength and saw it get hit.

I should have held my nerve for the 5.20am low of 1.6709 which was briefly touched but bounced off to now be sailing past my original entry. 👎

I should have held my nerve for the 5.20am low of 1.6709 which was briefly touched but bounced off to now be sailing past my original entry. 👎

HawkTrader

Established member

- Messages

- 620

- Likes

- 130

I've noticed the same too. I think it's to stop any break out players (maybe). I kept my stop at the 1H swing low, that's around 1.6705.

davechilde

Member

- Messages

- 88

- Likes

- 1

Whilst watching cable unfold and trying to resist closing out my USD/CAD which is now showing 100+pips, I missed the long on EUR/USD. I had it down for entry above 1.4990 with a stop at the last low in the 5M of 1.4690.

May also have been a short on USD/CHF (missed it anyway) at 1.0070 but given how that has been ranging in the 1H I think a break below 1.0055 might be better.

May also have been a short on USD/CHF (missed it anyway) at 1.0070 but given how that has been ranging in the 1H I think a break below 1.0055 might be better.

blancspa

Established member

- Messages

- 814

- Likes

- 35

I was so relyctant to wake up this morning that I missed the Euro/USD train. I went long at 1800GMT yesterday evening EUR/USD, yet I ve closed that trade for break even at 2000 GMT. It is probably because I have this scalping syndrome in me, I ve learned at prop shop, I am reluctant to stay in a trade overnight. I must work on exits.

Just to be able to catch the USD/CHF short connection this morning at 1.0073

I am looking for the EUR/GBP pair for last couple of weeks, yet what puts me off in GBP pairs are the agrresive whipsaws

If I only woke up 15 minutes erlier today...

Just to be able to catch the USD/CHF short connection this morning at 1.0073

I am looking for the EUR/GBP pair for last couple of weeks, yet what puts me off in GBP pairs are the agrresive whipsaws

If I only woke up 15 minutes erlier today...

davechilde

Member

- Messages

- 88

- Likes

- 1

Missed my own entry, nearly didn't bother, but in the end took a short at 1.0048.

Couldn't resist taking profits on USD/CAD, as I'm not one for holding positions, but more than happy with 116 pips in 2 days. It has however done little other than drop further since I closed it.

Cable and EUR/USD both seem to be flying at present, seems a good day all round for 3 ducks.

Couldn't resist taking profits on USD/CAD, as I'm not one for holding positions, but more than happy with 116 pips in 2 days. It has however done little other than drop further since I closed it.

Cable and EUR/USD both seem to be flying at present, seems a good day all round for 3 ducks.

Similar threads

- Replies

- 11

- Views

- 4K