marketbreaker

Junior member

- Messages

- 44

- Likes

- 1

Marketbreaker's post above raises a question for me.

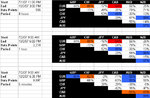

Although price was above the 240m 60sma (long) and above the 60m 60sma it was coming down towards the 60m 60sma and a prior low ... not leaving the 60m sma in an upwards direction. If that was a valid trade then any time price goes through the 5m 60sma while the other two smas are below price would be valid. Is it?

Hello nine

I think in Captain's strategy, he did not mention having the SMAs be in the up (for long) or down (for short) direction, or angle. However, he did mention that for long positions to be taken, price has to be above the 60EMAs on 4H, 1H and 5M time frames. Crosses on the 5M time frame, if met at first with the price being above the 60EMAs on the 4H and 1H time frame, can (not must) be taken.

Cheers

M