ducks not aligned yet ? hmm noting the time now and waiting for the cross to come in on the longer timeframe suggests it may kick off back end london close into late new yor and asia maybe ?

I think the longer 2 ma will cross at 3 pm uk, so then look for a 4 pm close above the red ma ?

:?: The averages don't need to actually cross according to the guidelines of this simple little observation as far as I understand it. Where did you read that inclusion CB?

All that's required to begin preparing for a potential long trigger is for price to be to the North of all 3 sma's.

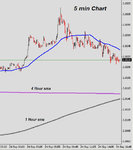

Once price has penetrated & held the Northerly ground on the 4 & 1hr timeframes, you begin homing in on the 5min frame to fine tune? your potential entry.

If you were looking to initiate a fresh entry late last week, then Friday lunchtime (London) offered a couple decent 5min bar leg in's with no real reason to book profits until the lazy pullback (lower lows & highs on the 5min) through 2.0270-250 today?

Price is now 0.5 cent shy of the averages on the 4 & 1 hr timeframes & channeling down on the 5min.

It's going to require a decent break & pullback above 2.0250 now to be honest, to not only negate the lower low/lower high roll (on the 5min), but also trigger another 'long' according to the 3 duck rule set.

Otherwise, if price threatens the 2 higher timeframe sma's at circa 2.0150, you'll be gearing up to flip to shorts on a likely pullback opp.

Like the guy suggests, utilizing this additional reference in harmony with local & regional support/resistance will probably assist in offering a heads up to near term directional flows.

Even more so if you also obey the peak & trough behaviour on your preferred template timeframe.

It's not a bad little piece of kit for (potential) front running entries via the 5min, then screwing back out & managing the position via the less windy hourlies!