This morning I found very frustrating:-

WTI

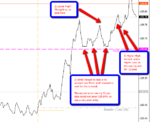

I entered a sell at 9:49/105.70. Because I'd missed the rapid sell off below pivot/BRN at 8.29 I was left with a worryingly lengthy stop, much less than ideal, however price fell but appeared to find confirmed support with a HL above 105.25 at 10:28, I stayed in as I felt that the LH's were in charge of the decline but I began to get nervous as price produced further HL's, eventually breaching MP, I was very uncomfortable with the sell and consequently took my leave at 11:12/105.59 with a grand total of +11 pips, much better than a loss!

EU

Similar story really, I won't bore you with the finer details, you can see what happened on my chart, again I got very nervous as price approached my sell entry and I took my leave with the even grander total of 1 pip!

Still both trades, although needing to be managed carefully, ended in profit, albeit slight. I now await the afternoon session, but with quite a bit of red flagged news I probably won't get involved until 2:30 at the earliest

WTI

I entered a sell at 9:49/105.70. Because I'd missed the rapid sell off below pivot/BRN at 8.29 I was left with a worryingly lengthy stop, much less than ideal, however price fell but appeared to find confirmed support with a HL above 105.25 at 10:28, I stayed in as I felt that the LH's were in charge of the decline but I began to get nervous as price produced further HL's, eventually breaching MP, I was very uncomfortable with the sell and consequently took my leave at 11:12/105.59 with a grand total of +11 pips, much better than a loss!

EU

Similar story really, I won't bore you with the finer details, you can see what happened on my chart, again I got very nervous as price approached my sell entry and I took my leave with the even grander total of 1 pip!

Still both trades, although needing to be managed carefully, ended in profit, albeit slight. I now await the afternoon session, but with quite a bit of red flagged news I probably won't get involved until 2:30 at the earliest