Decided to trade demo this afternoon as I was happy with the pips this morning on live. For me a messy session, eventually took a sell at 5-15 gmt, Nymex failing 107/PP again, with a limit order just above MP as I was making tea. Nice +38, then I discovered I had opened the wrong chart and it was live! So +103 pips today.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Leopard

Experienced member

- Messages

- 1,877

- Likes

- 1,021

There are so many problems with this ridiculous post I would hardly know where to begin with it.

Thanks KC.

When KC started this thread it was to bring to your attention a free resource based on Price Action at Support and Resistance, capable of making 350 pips on an average day (sometimes less, sometime more) trading EU, Crude and Dow. My Trading Plan's target is somewhat less than this though, but it is a target I regularly hit.

Our only involvement is that we utilise this system as our method of trading (yes, I do know KC Tiger) and we will not benefit in any way from future sales. As this isn't our system neither KC Tiger nor I are qualified to answer specific questions regarding the system's dynamics.

So could I politely request that if you have any comments or questions relating to the system that you ask the author directly? Just follow the link to website and make contact via the comments facility. You can also make contact via email, Facebook or Twitter. Julie is more than happy to answer questions relating to PATe.

That said, if you are looking for a strictly mechanical system with hard and fast black and white instructions, then this system probably isn't for you. PATe is much more about recognising how Price Action behaves and acting accordingly.

Anyway, there are only three "rules", if that is what you want to call them:

Rule 1 - Sell when price is at the top of a trend

Rule 2 - Buy is price is at the bottom of a trend

Rule 3 - If in doubt, stay out

How to recognise where the tops and bottoms are is contained on the website, but are also in the PDFs I have made available, and takes a few weeks to become proficient at.

Regards.

My apologies regarding this post and I cannot now remove it or edit it, so please just ignore it.

I didn't want to confuse anyone, and it appears that I have done just that with my "three rules". These are my rules, not Julie's.

Very sorry.

I didn't want to confuse anyone, and it appears that I have done just that with my "three rules". These are my rules, not Julie's.

Very sorry.

Thanks KC.

When KC started this thread it was to bring to your attention a free resource based on Price Action at Support and Resistance, capable of making 350 pips on an average day (sometimes less, sometime more) trading EU, Crude and Dow. My Trading Plan's target is somewhat less than this though, but it is a target I regularly hit.

Our only involvement is that we utilise this system as our method of trading (yes, I do know KC Tiger) and we will not benefit in any way from future sales. As this isn't our system neither KC Tiger nor I are qualified to answer specific questions regarding the system's dynamics.

So could I politely request that if you have any comments or questions relating to the system that you ask the author directly? Just follow the link to website and make contact via the comments facility. You can also make contact via email, Facebook or Twitter. Julie is more than happy to answer questions relating to PATe.

That said, if you are looking for a strictly mechanical system with hard and fast black and white instructions, then this system probably isn't for you. PATe is much more about recognising how Price Action behaves and acting accordingly.

Anyway, there are only three "rules", if that is what you want to call them:

Rule 1 - Sell when price is at the top of a trend

Rule 2 - Buy is price is at the bottom of a trend

Rule 3 - If in doubt, stay out

How to recognise where the tops and bottoms are is contained on the website, but are also in the PDFs I have made available, and takes a few weeks to become proficient at.

Regards.

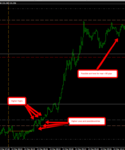

A VERY frustrating morning for me but a VERY nice post Oil Inventories buy more than made up for all of my frustrations.

I managed a painful 24 pips from a crude sell this morning but my post inventories trade went like this:-

The session low was 104.33 at 14.41, this was followed by a HL of 104.43 at 15.28 just before inventories hit, OI drove price up to 104.98 by 15:34, taking out a previous LH at 104.76/16:01, and then retraced to produce a confirming HL above MP at 104.53 at 15:48, I took my entry at 104.70 at 15:49 and exited at 105.73 at 16:10 for 103 pips.

A VERY frustrating morning for me but a VERY nice post Oil Inventories buy more than made up for all of my frustrations.

I managed a painful 24 pips from a crude sell this morning but my post inventories trade went like this:-

The session low was 104.33 at 14.41, this was followed by a HL of 104.43 at 15.28 just before inventories hit, OI drove price up to 104.98 by 15:34, taking out a previous LH at 104.76/16:01, and then retraced to produce a confirming HL above MP at 104.53 at 15:48, I took my entry at 104.70 at 15:49 and exited at 105.73 at 16:10 for 103 pips.

Finished the day off nicely for me, thanks Jules, and thanks Oil Inventories aftermath 😀

I managed a painful 24 pips from a crude sell this morning but my post inventories trade went like this:-

The session low was 104.33 at 14.41, this was followed by a HL of 104.43 at 15.28 just before inventories hit, OI drove price up to 104.98 by 15:34, taking out a previous LH at 104.76/16:01, and then retraced to produce a confirming HL above MP at 104.53 at 15:48, I took my entry at 104.70 at 15:49 and exited at 105.73 at 16:10 for 103 pips.

A VERY frustrating morning for me but a VERY nice post Oil Inventories buy more than made up for all of my frustrations.

I managed a painful 24 pips from a crude sell this morning but my post inventories trade went like this:-

The session low was 104.33 at 14.41, this was followed by a HL of 104.43 at 15.28 just before inventories hit, OI drove price up to 104.98 by 15:34, taking out a previous LH at 104.76/16:01, and then retraced to produce a confirming HL above MP at 104.53 at 15:48, I took my entry at 104.70 at 15:49 and exited at 105.73 at 16:10 for 103 pips.

Finished the day off nicely for me, thanks Jules, and thanks Oil Inventories aftermath 😀

Attachments

WTI opening rule this morning was a rule 5/rule 6 buy but it appeared to struggle, as may have been expected, at 106.50, mid point (MP), so I waited for price to give me some confirmed intent at 8:09 as price pushed through MP to make a new session high at 106.69, the initial retrace at 8:19 only gave a minimum low of 106.62 which was uncomfortably too far away from the session low, as this was the first HL above MP I decided to await confirmation, this duly arrived in the form of a double bottom at 8:50 & 9:10, I entered at 9:18/106.68, the double top at 9:35 & 9:46 had me concerned, also the fact that price had managed to retrace back through BRN and R1, so I took my leave at 9:54 with 28 pips

EU opening rule was a straight forward rule 5 buy, price had opened above MP and I was interested to see the double bottom at 7:26 & 7:41, what I then felt that I needed for confirmation of that area being the floor was to see a new session high made, that duly arrived at 8:09 with price pushing up to 1.3183, I now needed a retrace as close to the session low as possible, in my eagerness, and not wanting to miss the move, I entered my buy too early at 1.3178/8:18, this still gave me a comfortable stop below the session low though should price have moved against me. After a drift down price took off at 10:13 making yet another new session high, I was wary of the fact that my trade was then approaching BRN and R2, I watched price through both of these areas but got spooked at 9:54 when price appeared to begin to flatten out, on reflection I should have held as price was still above BRN, it was possibly my exit on WTI that hastened my EU exit, whatever it was I exited for +36 pips.

So my total for the European session was a combined +64 and I'm very happy with that, so thanks Julie!

EU opening rule was a straight forward rule 5 buy, price had opened above MP and I was interested to see the double bottom at 7:26 & 7:41, what I then felt that I needed for confirmation of that area being the floor was to see a new session high made, that duly arrived at 8:09 with price pushing up to 1.3183, I now needed a retrace as close to the session low as possible, in my eagerness, and not wanting to miss the move, I entered my buy too early at 1.3178/8:18, this still gave me a comfortable stop below the session low though should price have moved against me. After a drift down price took off at 10:13 making yet another new session high, I was wary of the fact that my trade was then approaching BRN and R2, I watched price through both of these areas but got spooked at 9:54 when price appeared to begin to flatten out, on reflection I should have held as price was still above BRN, it was possibly my exit on WTI that hastened my EU exit, whatever it was I exited for +36 pips.

So my total for the European session was a combined +64 and I'm very happy with that, so thanks Julie!

Attachments

yesterday (8/3): Late afternoon Crude Oil made yet another attempt to break the 107/R1 road-block that held it up all day. I took a sell at 16:45 GMT from this obvious high down to 106.50 and closed for the day. Easy 45 pips after spread removed.

Last edited:

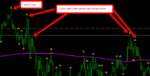

WTI

At 08:18 I entered a sell off LH's below both the session high and BRN, my entry was at 106.89. I felt that, eventually, price would make 106.00 even though it began to range and was never really what you'd call comfortable until after NY came on, I closed the trade out at 106.08 for +81 pips as price began to retrace, I did think that price may retrace back to pivot before tanking again but I decided that 81 pips was good enough as it exceeded my daily target.

I should mention that as red flagged news and NY open approached I tightened my stops substantially, I was willing to risk a few pips as the R:R looked very favourable, on this occasion it went in my favour!

At 08:18 I entered a sell off LH's below both the session high and BRN, my entry was at 106.89. I felt that, eventually, price would make 106.00 even though it began to range and was never really what you'd call comfortable until after NY came on, I closed the trade out at 106.08 for +81 pips as price began to retrace, I did think that price may retrace back to pivot before tanking again but I decided that 81 pips was good enough as it exceeded my daily target.

I should mention that as red flagged news and NY open approached I tightened my stops substantially, I was willing to risk a few pips as the R:R looked very favourable, on this occasion it went in my favour!

Attachments

Entered a sell off the session high/R1 but man it was it a painful session. As 107 had proved resistance all morning I move my stop to just above this pre-news as it would only have cost me a few pips if I was wrong. I know this was gambling not trading, and certainly would not make this a habit, but on this occasion a sensible stop for a few pips risk was worth it.

The correct action would have been to close and re-enter on the failure of 107 shortly after the news, as Julie said on a Facebook update.

Either way, on this occasion, the sell worked out just fine at I closed for 82 pips, having exceeded my daily target. The trade was open for 5 hours though!

So a PATe entry, but not PATe trade management; for once I got lucky.

However, I am more happy that a) I identified and took a good entry and b) held the trade through some serious retraces, trusting that at least 106.50 would be tackled and did not get “bullied” out of what turned in to a decent trade.

The correct action would have been to close and re-enter on the failure of 107 shortly after the news, as Julie said on a Facebook update.

Either way, on this occasion, the sell worked out just fine at I closed for 82 pips, having exceeded my daily target. The trade was open for 5 hours though!

So a PATe entry, but not PATe trade management; for once I got lucky.

However, I am more happy that a) I identified and took a good entry and b) held the trade through some serious retraces, trusting that at least 106.50 would be tackled and did not get “bullied” out of what turned in to a decent trade.

prophetable

Newbie

- Messages

- 7

- Likes

- 0

KC - Thanks for the trade example.

I have been trying to follow PATe for a while and looked at this scenario in WTI yesterday but did not trade.

What i dont understand is that the Open of the GMT session at 0700 indicated a BUY and i was trying to look at the post 30 minute seesion to see if the low held and we had a succession of higher lows for a BUY.

But you guys all SOLD???

Didnt the opening sequence open between the Pivot and R1 smack bang in the middle suggesting a buy if Price Action confirmed?

This is the part i am not understanding - the switch from the initial indication to the opposing one......:?:

Interested in hearing your ideas on this.

Cheers

I have been trying to follow PATe for a while and looked at this scenario in WTI yesterday but did not trade.

What i dont understand is that the Open of the GMT session at 0700 indicated a BUY and i was trying to look at the post 30 minute seesion to see if the low held and we had a succession of higher lows for a BUY.

But you guys all SOLD???

Didnt the opening sequence open between the Pivot and R1 smack bang in the middle suggesting a buy if Price Action confirmed?

This is the part i am not understanding - the switch from the initial indication to the opposing one......:?:

Interested in hearing your ideas on this.

Cheers

WTI

At 08:18 I entered a sell off LH's below both the session high and BRN, my entry was at 106.89. I felt that, eventually, price would make 106.00 even though it began to range and was never really what you'd call comfortable until after NY came on, I closed the trade out at 106.08 for +81 pips as price began to retrace, I did think that price may retrace back to pivot before tanking again but I decided that 81 pips was good enough as it exceeded my daily target.

I should mention that as red flagged news and NY open approached I tightened my stops substantially, I was willing to risk a few pips as the R:R looked very favourable, on this occasion it went in my favour!

Hi Honda,

I hope you have read Trading In The Zone by Mark Douglas. It is really a must read book for any trader.

Anyway, Chapter 6 of said book is most apposite to your question as it does state:

Basically, regardless of Julie’s tweets and opening rules you have to always keep aware of what Price Action is telling you. Julie does say that Opening Rules have to be confirmed by subsequent Price Action.

In an uptrend we do not know where resistance will form, only that it will at some point. By “consciously opening yourself up to find out what will happen next” we learn to look for the clues that resistance has formed as this will provide sell opportunities.

With our Sells; Price Action broke 107 to make a high at 107.11 (7:44 gmt). The next attempt did not get as high as this, failure to make HHs above 107 means the move is not progressive and is your first clue to a sell. The failure to even get above 107 at 8:08 was enough confirmation for me. Note that at 10:00 gmt there was yet another failure to get above 107 (on my charts anyway), so this confirmed the sell I was already in, but would have provided another entry if required.

Hope that helps.

I hope you have read Trading In The Zone by Mark Douglas. It is really a must read book for any trader.

Anyway, Chapter 6 of said book is most apposite to your question as it does state:

“However, what you don't know is exactly how the pattern your variables identify will unfold. With the perspective of making yourself available, you know that your edge places the odds of success in your favour (sic), but, at the same time, you completely accept the fact that you don't know the outcome of any particular trade. By making yourself available, you consciously open yourself up to find out what will happen next; instead of giving way to an automatic mental process that causes you to think you already know.”

Basically, regardless of Julie’s tweets and opening rules you have to always keep aware of what Price Action is telling you. Julie does say that Opening Rules have to be confirmed by subsequent Price Action.

In an uptrend we do not know where resistance will form, only that it will at some point. By “consciously opening yourself up to find out what will happen next” we learn to look for the clues that resistance has formed as this will provide sell opportunities.

With our Sells; Price Action broke 107 to make a high at 107.11 (7:44 gmt). The next attempt did not get as high as this, failure to make HHs above 107 means the move is not progressive and is your first clue to a sell. The failure to even get above 107 at 8:08 was enough confirmation for me. Note that at 10:00 gmt there was yet another failure to get above 107 (on my charts anyway), so this confirmed the sell I was already in, but would have provided another entry if required.

Hope that helps.

Attachments

KC - Thanks for the trade example.

I have been trying to follow PATe for a while and looked at this scenario in WTI yesterday but did not trade.

What i dont understand is that the Open of the GMT session at 0700 indicated a BUY and i was trying to look at the post 30 minute seesion to see if the low held and we had a succession of higher lows for a BUY.

But you guys all SOLD???

Didnt the opening sequence open between the Pivot and R1 smack bang in the middle suggesting a buy if Price Action confirmed?

This is the part i am not understanding - the switch from the initial indication to the opposing one......:?:

Interested in hearing your ideas on this.

Cheers

Hi Honda

I think Hiart has answered your question whilst I was trading this morning, but my two penneth would be this:-

Julie gives seven opening rules which you've obviously read, she also gives daily advice on her Facebook page whereby the inital part of her daily advice offers a hint as to which direction she thinks price is going to move, however either or both of the aforesaid NEED to be confirmed by price action, and that can only be done by watching the charts very carefully between 7:00 & 7:30, and even after that point you may still need to wait a while to get confirmation of intent, I hope that helps.

My two EU trades this morning are as follows:-

At 7:57 I had seen a double bottom at 7:06 & 7:27, this was followed by a HL at 7:40 and a new session high at 7:45, I entered my buy at 7:57/1.3048 which was not a particularly brilliant entry point as it was the wrong side of MP but price action had shown bullish intent and my stop was pegged behind the session low, I began to get nervous at 10:53 as price appeared to be struggling to make a new session high, in hindsight I should have had faith in the constant HL's, anyway I took my leave at that point with 17 pips.

At 11:23 I saw that price was struggling at its session high, which was also close enough to BRN for me to get interested and peg my stop behind both for a sell, as it made LH's below the session high I entered at 1.3085, as this was potentially a retrace, combined with the time of day, I was never going to stay in the trade very long, I exited at 12:17 as NY open approached with 16 pips, price moved further after my exit however the safe thing to do, for me, was to exit and see how NY was going to impact the market.

So +33 pips for the morning, and I will now not likely trade until post Oil Inventories, to try and collect some pips from the aftermath!

Attachments

prophetable

Newbie

- Messages

- 7

- Likes

- 0

HiArt and KC,

Thankyou for your insights. They are appreciated.

I have struggled with the real time application of Julies PATe approach. Theoretically i get it and can see a lot of merit in it. However i do struggle to put it all into practice with the trading mindset that i currently have.

I think i was assuming it was a fairly 'black and white' approach but in reality it is more discretionary in its entirety.

That is fine as i see a lot of times of recent where applying your working knowledge of price action setups and support and resistance together with PATe and BRNs would have made many a profitable trade. I havent taken these trades however as i was trying to apply the PATe approach on its own. I think a more holistic approach is necessary whereby you dont have a pre-meditated outcome in your mind - as you mentioned HiArt- that has been placed there by the "rules" of the PATe approach.

I need to look at more trade setups that involve price initially showing you its hand one way - and then turning the other way a short while later to provide the exact opposite setup and learn to approach them in a way that can be put into a trading plan.

Always learning........

Cheers

Thankyou for your insights. They are appreciated.

I have struggled with the real time application of Julies PATe approach. Theoretically i get it and can see a lot of merit in it. However i do struggle to put it all into practice with the trading mindset that i currently have.

I think i was assuming it was a fairly 'black and white' approach but in reality it is more discretionary in its entirety.

That is fine as i see a lot of times of recent where applying your working knowledge of price action setups and support and resistance together with PATe and BRNs would have made many a profitable trade. I havent taken these trades however as i was trying to apply the PATe approach on its own. I think a more holistic approach is necessary whereby you dont have a pre-meditated outcome in your mind - as you mentioned HiArt- that has been placed there by the "rules" of the PATe approach.

I need to look at more trade setups that involve price initially showing you its hand one way - and then turning the other way a short while later to provide the exact opposite setup and learn to approach them in a way that can be put into a trading plan.

Always learning........

Cheers

No worries Honda, and I thank you for thanking me :cheers:

It's nice to know that people are reading the thread as Julie's method, in my honest opinion, fully justifies and warrants attention, in my experience she is one of the very few honest trading mentors

It's nice to know that people are reading the thread as Julie's method, in my honest opinion, fully justifies and warrants attention, in my experience she is one of the very few honest trading mentors

You're welcome.

GJ this morning was a totally different beast, Opened as a Rule 5 BUY, never got close to the BRN of 130, in fact the initial floor of 130.14 held and boy did it push up.

Nice confirmation of a Rule 5 and if you caught it a very easy trade.

So when the rules confirm they do work very nicely.

GJ this morning was a totally different beast, Opened as a Rule 5 BUY, never got close to the BRN of 130, in fact the initial floor of 130.14 held and boy did it push up.

Nice confirmation of a Rule 5 and if you caught it a very easy trade.

So when the rules confirm they do work very nicely.

Attachments

Last edited:

I fully appreciate what Hiart's saying in his post above, this method works successfully on a just about any instrument, however I would ask, to avoid confusion/distraction, that traders looking at PATe, especially new traders, concentrate on the instruments that Julie is currently advising on, which are EU & WTI.

All of the others can come later 👍

All of the others can come later 👍

Afternoon session done and dusted for me by 15:17, my trades:-

WTI

Post inventories there was an obvious spike north which STILL failed to deal with 107.00, for me this informed me that there was obvious strength in resistance at that BRN, I waited to see if price COULD push on, when it looked like it had failed I entered my sell at 14:47/106.83, pegging my stop behind the session high and BRN at 107.07, my exit came at 15:08/106.22 for +61 pips, the main reason for my exit was obviously the potential reaction at 106 plus S1 which was just behind it.

EU

Since NY open price had failed to get above 1.3075 which was a crucial level that Julie had mentioned this morning, I gave the trade a 21 pip stop which covered 3075 & the afternoon session high, I took a sell entry at 1.3058/14:48 and took my leave at 1.3029/15:17 for 29 pips, my main reason for exit obviously being the potential support at S1.

So +90 pips for the afternoon session, job done, thanks Jules

WTI

Post inventories there was an obvious spike north which STILL failed to deal with 107.00, for me this informed me that there was obvious strength in resistance at that BRN, I waited to see if price COULD push on, when it looked like it had failed I entered my sell at 14:47/106.83, pegging my stop behind the session high and BRN at 107.07, my exit came at 15:08/106.22 for +61 pips, the main reason for my exit was obviously the potential reaction at 106 plus S1 which was just behind it.

EU

Since NY open price had failed to get above 1.3075 which was a crucial level that Julie had mentioned this morning, I gave the trade a 21 pip stop which covered 3075 & the afternoon session high, I took a sell entry at 1.3058/14:48 and took my leave at 1.3029/15:17 for 29 pips, my main reason for exit obviously being the potential support at S1.

So +90 pips for the afternoon session, job done, thanks Jules

Attachments

Similar threads

- Replies

- 34

- Views

- 13K