The key points that I learnt in 2013 about Stan Weinstein's method.

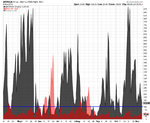

Volume is just as important today as it was back when Weinstein wrote the book. We had discussed on this old thread and earlier in the year whether volume was as important anymore due to indexing, ETFs and dark pools etc. But through the course of doing the Stage Analysis forum and the daily scans for breakouts and breakdowns etc I've come to realise that it's just as important today as it was back then, it's just only visible mostly the small caps that aren't distorted by the indexing etc.

The vast majority of Stage 2A breakouts occur when the relative performance is above the zero line or on the week it crosses it. However, if the four key components of the method aren't all present - i.e. price action breakout, 2x volume, relative performance above zero line, above or moving above long term resistance - then avoid.

The Relative Performance Zero Line (52 week moving average of the stock divided by the S&P 500) is a useful guide as to whether a Stage 2A breakout will be successful or not. The Mansfield RS flattened the zero line, but by viewing the unflattened MA you can get additional vital information as to whether it's too early for a stock to breakout or not successfully. As I've noticed through the hundreds of charts I look at daily that if the zero line is still declining sharply when the Stage 2A breakout occurs, that the stock will struggle to advance. It doesn't mean that it won't advance, but that the most successful Stage 2A breakouts occur when the zero line is either flattening or already moving higher.

Never to buy a breakout trading under heavy / any near term resistance. I define this using the weekly Ichimoku Cloud as I can instantly see the resistance then when scanning through the charts each day and filter out any setups that aren't ready and will need more time to work through the resistance first. Any that aren't ready can be put on a longer term watchlist that can be reviewed occasionally for if and when they are ready to clear resistance.

A+ setups occur regularly in the small/mid caps but are rare in the large cap stocks. So you should never compromise in the small and mid cap stocks - remember the excerpt about opportunity cost from the book.

Moving on to 2014 - the last year in the market was very strong by historical standards and a lot of traders will be patting themselves on the back for doing so well as so many stocks went up, and so it's easy to get complacent. But we never know whats going to happen next in the market, and with the US markets continuing in Stage 2B currently we need to continue to focus, especially on the quality of trades we now make, and also on the stocks already in our portfolios, as they are the best guide to whats really happening in the market imo, along with the market breadth data.

Good luck with your trading and investing in 2014, and please try to get involved with the new Stage Analysis website if you use Stan Weinstein's method, even if only in a small way.

Happy New Year