isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

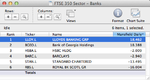

Commodities Update and the Dollar Index

Attached is the updated major commodities charts, Gold (GC), Copper (HG), West Texas Intermediate Crude (CL) and the Dollar Index (DX).

Attached is the updated major commodities charts, Gold (GC), Copper (HG), West Texas Intermediate Crude (CL) and the Dollar Index (DX).