Attached is the current major charts for your own stage analysis. I've updated the market breadth thread as well so that we can see what the weight of evidence is suggesting this week from the market internals here:

http://www.trade2win.com/boards/technical-analysis/147476-market-breadth-24.html#post2056574

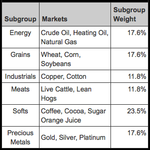

Below is the updated relative performance table in order of strength using the daily Mansfield RS reading. Crude Oil was the notable mover this week and continued to climb the relative performance rankings and is now only one position below the S&P 500 and hence close to crossing above it's zero line. This positive price action can be seen on the chart with the price breaking above resistance of the one year downtrend line and the 30 week MA turning up for a number of weeks now. There is however still near term resistance up to the 100 zone and so it could possibly still be in a broader Stage 1 recovery phase. But with the break out above horizontal resistance around the 94 zone it may be in Stage 2A now.

Also included in this weeks roundup is the five year weekly Apple (AAPL) chart. I've included this chart to highlight the test of the four year trend line that AAPL made this week, which has been tested five times previously since 2009 and held. So it will be interesting to see if it holds again on this sixth attempt to break it.

The S&P 500 broke out to new highs and has now joined the NYSE and Russell 2000 in potential Stage 2 continuation moves. However, the Nasdaq 100 still continues to lag and ended the week slightly lower at the top of it's recent range that it has formed since the beginning of the year. So I'd put it in Stage 1B as this point personally. The relative performance table also shows that the small caps are outperforming the mega caps currently as the S&P 100 continues to under perform the other stock indexes except for the Nasdaq 100.

Gold (GC) moved higher for a second weekend has now put in a new swing low at 1626. If it can close back above it's 50 day MA and the downtrend line around the 1700 level, then it may become interesting again. As that would be a failed Stage 4 breakdown and hence it would recover it's Stage 1 rating. Currently I'd give it a Stage 4A-

US Treasuries (US & TY) held the key support levels that I mentioned a few weeks back and have completed new swing lows, as they have traded higher for another week - contrary to their normal inverse relationship with equities. So they continue in Stage 3B for time being.

The Dollar Index continues to trade sideways since failing to move below the major support after breaking down into Stage 4 in September. It's formed a clear short term range, but it continues to mostly trade below it's key MAs, and the 30 week MA is still falling, so it's currently still in Stage 4B-

The VIX is interesting as it broke down to new lows this week that haven't been seen since the 2004 to early 2007 period, where it consistently traded at low levels during the majority of that bullish period. So the volatility traders are clearly extremely bullish at this point.