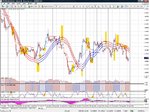

Sniper variant: !!untested!! (as requested earlier in the day)

reasoning: I trade pullbacks. If HMA channel is optimal setting of 30 for the hourly, then I replicate it in essence, by using 120 on the 15mins.

Since I am a pullback trader, I have added Stochs(12,3,3) onto the chart.

Also, bog standard MACD.

Observations: Since the chart is simply a 15-min proxy for the 60-mins, I can now look for pullbacks.

I effectively ignore Sniper A and B since I dont know what they represent. I only want to use indicators I understand, so I know when to use them, and when to ignore them.

Note now, the stop-loss can be used as a pullback entry.

When the HMAs are 3 blues: take the entry if the price is "close" to the HMAs. This is subjective. If price has run away too far from the Hulls, I would rather not enter, and wait for a pullback.

In an uptrend (3-blues), this can be:

a: Stochs goes Oversold, and hooks up. (anywhere on the histogram)

b: Price falls back to "stop-loss". (blue dots)

In a downtrend (3 reds), entry can be:

a: Stochs going overbought and hooking down.

b: Price rises upto the "stop-loss". (red dots)

Actual stop-loss is also under investigation. Either way, you can reduce your risk exposure by using Price Action, such as the High caused by the Stochs overbought signal in a downtrend, or the Lows caused by the Stochs OS signal. Up to you.

Exits: I have added 0.002 and -0.002 to the MACD. I am only interested when the MACD exceeds 0.002/-0.002 and hooks back. This I am experimenting as an extreme point exit. I use this to take profits, rather than let them slip away.

All of the above is my initial reaction to Sniper. I am a pullback player, so I modified it to meet my personal psychology.

NB: the sample chart shows in essence what I am thinking. I miss moves. And get it wrong. But I can get in at a bargain price. Hope this stimulates some positive discussion. Or gets ignored to the dustbin of pie-in-the-sky fantasies. Either way, I am not fussed. Good trading. 😎

I am likely to miss some moves, but so what, its not my only method.

I dont trade this with real money.

EDIT: chart is actually 120 on hourly. DOH. but you get the point! try the 120 on 15-mins.

EDIT2: just added a proper 15min version. The MACD exits are the more useful bits here.