VSATrader

Guest

- Messages

- 160

- Likes

- 26

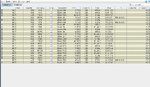

ES Analysis for Monday 26th Nov 07

I will continue with this layout, because it is quicker than the previous, which took 2 hours.

Thursdays sheet, used png's, I have returned to using gifs, so there should be no errors opening this PDF.

Regards Sebastian

I will continue with this layout, because it is quicker than the previous, which took 2 hours.

Thursdays sheet, used png's, I have returned to using gifs, so there should be no errors opening this PDF.

Regards Sebastian