You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

EU Leaders Summit to dominate markets

* Expectations of ECB action set to grow

* Italian debt auctions eyed

LONDON, June 22 (Reuters) - Investors are approaching the coming week's crucial European Union leaders summit braced for disappointment but keen to put money to work on any signs of a unified and comprehensive plan to tackle the region's 30-month-long debt crisis.

Wealth managers and analysts say no one really expects the meeting on June 28 and 29 to produce the definitive solution. A credible plan supported by all nations with a realistic implementation time line, however could start to bring investors back.

"It's very painful for professional investors and retail investors to hold cash and bonds in this environment when you look at inflation," said Lorne Baring, managing director of Swiss asset manager B Capital Wealth Management.

Baring said investors would prefer to be owning strong international companies that have cash-rich balance sheets and pay good dividends.

"But they are held back by headlines created by the inactivity of politicians," he said. "It's just wiping trillions off the value of equities globally and, frankly, unnecessarily so."

Analysts at Barclays Bank (NYSE: BCS-PA - news) said investors wanted to see three things emerge from the summit: a roadmap to fiscal integration, moves toward better supervision of the region's banking sector, and measures to revive economic growth.

"I don't think many people really expect a silver bullet to be delivered. People have realised that there is no easy solution," Laurent Fransolet, head of European fixed income research at Barclays Capital, said.

But he said with short-term Italian debt offering yields of around four percent versus safe haven bonds and similar assets at close to zero returns, if some progress was made people would start to think about buying.

"If you really curtail the tail risk then it makes it a little bit more attractive," he said.

However, he also cautioned: "The nervousness in these markets and the risk aversion is going to be exceptionally high even if we get some relief in the near term."

CENTRAL BANK BACKSTOP

Equity investors have been generally resilient to the cycle of crisis in Europe (Chicago Options: ^REURUSD - news) this year, clinging to a view central banks will continue to manage the world economy and limit the impact of Europe's problems on global growth.

World stocks as measured by MSCI's main global equity index are up 1.2 percent year to date and the widely- tracked S&P 500 (SNP: ^GSPC - news) index of U.S. stocks has gained 5.4 percent.

But these gains are mainly due to the assistance already provided, signs central banks remain ready to act, and forecasts that growth outside Europe will persist this year due mainly to activity in emerging markets like China.

Although disappointment that the U.S. Federal Reserve did not go further to counteract growing signs of a slowdown in its economy at its most recent meeting dented some of this optimism in the past week.

Barclays (LSE: BARC.L - news) ' latest global outlook forecasts the world economy will grow by 3.5 percent in 2012, in line with most other major forecasters, and by 3.9 percent in 2013 despite a downward revision to growth in the United States.

Hopes among some that the European Central Bank could step in with a rate cut at its next meeting in early July could get a boost from the release the euro area's harmonised index of consumer prices (HICP) on June 29.

The inflation reading is expected to be stable in June after falling to its lowest level in over a year in May at 2.4 percent, due to a big fall in energy and commodity prices.

The index may even fall further given the weakness in energy prices this month. The price of Brent has fallen by around 7.5 in the past week and has slid by about 30 percent from its 2012 high of $128.40 reached in March.

Data on bank lending to the private sector and growth in the M3 monetary aggregate, both for May, could also fuel expectations of a rate cut as these have been slowing since the central bank ended a programme of massive liquidity injections into the banking system.

The ECB released over 1 trillion euros in cheap three-year loans (LTROs) to banks in December and February, taking the heat out of a feared credit crisis in the first quarter of this year.

Many economist now expect a cut in interest rates at the ECB's next policy meeting on July 5, an option several policymakers have also mentioned since they were left unchanged at the June 6 meeting.

Europe's peripheral bond markets will be focused on Italy's sale of zero-coupon and inflation-linked bonds on Tuesday and medium- and longer-term bonds on Thursday. Spain is also due to sell three-and six-month Treasury bills on Tuesday.

Both Spain and Italy are finding it increasingly hard to finance themselves in bond markets and still have a lot of money to raise to meet their funding requirements.

Italy's 10-year government bond yields are currently around at 5.80 percent with equivalent Spanish debt at 6.55 percent.

Their Treasuries will both be hoping that European leaders do enough at the upcoming Summit (Berlin: UVF.BE - news) to encourage buyers.

(Editing by Jeremy Gaunt)

...

.

* Expectations of ECB action set to grow

* Italian debt auctions eyed

LONDON, June 22 (Reuters) - Investors are approaching the coming week's crucial European Union leaders summit braced for disappointment but keen to put money to work on any signs of a unified and comprehensive plan to tackle the region's 30-month-long debt crisis.

Wealth managers and analysts say no one really expects the meeting on June 28 and 29 to produce the definitive solution. A credible plan supported by all nations with a realistic implementation time line, however could start to bring investors back.

"It's very painful for professional investors and retail investors to hold cash and bonds in this environment when you look at inflation," said Lorne Baring, managing director of Swiss asset manager B Capital Wealth Management.

Baring said investors would prefer to be owning strong international companies that have cash-rich balance sheets and pay good dividends.

"But they are held back by headlines created by the inactivity of politicians," he said. "It's just wiping trillions off the value of equities globally and, frankly, unnecessarily so."

Analysts at Barclays Bank (NYSE: BCS-PA - news) said investors wanted to see three things emerge from the summit: a roadmap to fiscal integration, moves toward better supervision of the region's banking sector, and measures to revive economic growth.

"I don't think many people really expect a silver bullet to be delivered. People have realised that there is no easy solution," Laurent Fransolet, head of European fixed income research at Barclays Capital, said.

But he said with short-term Italian debt offering yields of around four percent versus safe haven bonds and similar assets at close to zero returns, if some progress was made people would start to think about buying.

"If you really curtail the tail risk then it makes it a little bit more attractive," he said.

However, he also cautioned: "The nervousness in these markets and the risk aversion is going to be exceptionally high even if we get some relief in the near term."

CENTRAL BANK BACKSTOP

Equity investors have been generally resilient to the cycle of crisis in Europe (Chicago Options: ^REURUSD - news) this year, clinging to a view central banks will continue to manage the world economy and limit the impact of Europe's problems on global growth.

World stocks as measured by MSCI's main global equity index are up 1.2 percent year to date and the widely- tracked S&P 500 (SNP: ^GSPC - news) index of U.S. stocks has gained 5.4 percent.

But these gains are mainly due to the assistance already provided, signs central banks remain ready to act, and forecasts that growth outside Europe will persist this year due mainly to activity in emerging markets like China.

Although disappointment that the U.S. Federal Reserve did not go further to counteract growing signs of a slowdown in its economy at its most recent meeting dented some of this optimism in the past week.

Barclays (LSE: BARC.L - news) ' latest global outlook forecasts the world economy will grow by 3.5 percent in 2012, in line with most other major forecasters, and by 3.9 percent in 2013 despite a downward revision to growth in the United States.

Hopes among some that the European Central Bank could step in with a rate cut at its next meeting in early July could get a boost from the release the euro area's harmonised index of consumer prices (HICP) on June 29.

The inflation reading is expected to be stable in June after falling to its lowest level in over a year in May at 2.4 percent, due to a big fall in energy and commodity prices.

The index may even fall further given the weakness in energy prices this month. The price of Brent has fallen by around 7.5 in the past week and has slid by about 30 percent from its 2012 high of $128.40 reached in March.

Data on bank lending to the private sector and growth in the M3 monetary aggregate, both for May, could also fuel expectations of a rate cut as these have been slowing since the central bank ended a programme of massive liquidity injections into the banking system.

The ECB released over 1 trillion euros in cheap three-year loans (LTROs) to banks in December and February, taking the heat out of a feared credit crisis in the first quarter of this year.

Many economist now expect a cut in interest rates at the ECB's next policy meeting on July 5, an option several policymakers have also mentioned since they were left unchanged at the June 6 meeting.

Europe's peripheral bond markets will be focused on Italy's sale of zero-coupon and inflation-linked bonds on Tuesday and medium- and longer-term bonds on Thursday. Spain is also due to sell three-and six-month Treasury bills on Tuesday.

Both Spain and Italy are finding it increasingly hard to finance themselves in bond markets and still have a lot of money to raise to meet their funding requirements.

Italy's 10-year government bond yields are currently around at 5.80 percent with equivalent Spanish debt at 6.55 percent.

Their Treasuries will both be hoping that European leaders do enough at the upcoming Summit (Berlin: UVF.BE - news) to encourage buyers.

(Editing by Jeremy Gaunt)

...

.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

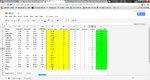

W/E 22nd June - Results

I had a suspicion that it would be a choppy week with it moving sideways but I wasn't really expecting the S&P to behave with quite the volatility it displayed on FOMC day and then the big sell-off on Thursday. The quadruple witching day yesterday turned out to be a damp squib. So it finished on a perfectly 'sideways' 1335.02 or marginally down from last week.

Interestingly there were only 3 people that called a down week and our Robin, Barry and Maurice Gibb for this week are:

1) Atilla - 1342 (6.98)

2) wackypete2 - (-16.02)

3) tar - 1290 (-45.02)

So congrats to our three market falsetto crooners for being about the only people to not go for an up week. :clap::clap::clap:😛😛😛😆😆😆:clover:

Now the leaderboard. There is one week left and Atilla has bagged it looking at the maths. However it could be a joint win if Pete gets the top spot on the podium next week and Atilla fluffs direction. So will Atilla be the lone star of Q2 or will Pete demand the adoration of the crowd too?

Link to full results

I had a suspicion that it would be a choppy week with it moving sideways but I wasn't really expecting the S&P to behave with quite the volatility it displayed on FOMC day and then the big sell-off on Thursday. The quadruple witching day yesterday turned out to be a damp squib. So it finished on a perfectly 'sideways' 1335.02 or marginally down from last week.

Interestingly there were only 3 people that called a down week and our Robin, Barry and Maurice Gibb for this week are:

1) Atilla - 1342 (6.98)

2) wackypete2 - (-16.02)

3) tar - 1290 (-45.02)

So congrats to our three market falsetto crooners for being about the only people to not go for an up week. :clap::clap::clap:😛😛😛😆😆😆:clover:

Now the leaderboard. There is one week left and Atilla has bagged it looking at the maths. However it could be a joint win if Pete gets the top spot on the podium next week and Atilla fluffs direction. So will Atilla be the lone star of Q2 or will Pete demand the adoration of the crowd too?

Link to full results

Attachments

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Re: W/E 22nd June - Results

Who writes your script?😆

Soap (TV comedy) closing credits #2 - YouTube

I had a suspicion that it would be a choppy week with it moving sideways but I wasn't really expecting the S&P to behave with quite the volatility it displayed on FOMC day and then the big sell-off on Thursday. The quadruple witching day yesterday turned out to be a damp squib. So it finished on a perfectly 'sideways' 1335.02 or marginally down from last week.

Interestingly there were only 3 people that called a down week and our Robin, Barry and Maurice Gibb for this week are:

1) Atilla - 1342 (6.98)

2) wackypete2 - (-16.02)

3) tar - 1290 (-45.02)

So congrats to our three market falsetto crooners for being about the only people to not go for an up week. :clap::clap::clap:😛😛😛😆😆😆:clover:

Now the leaderboard. There is one week left and Atilla has bagged it looking at the maths. However it could be a joint win if Pete gets the top spot on the podium next week and Atilla fluffs direction. So will Atilla be the lone star of Q2 or will Pete demand the adoration of the crowd too?

Link to full results

Who writes your script?😆

Soap (TV comedy) closing credits #2 - YouTube

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

Re: W/E 22nd June - Results

Pete,

Kindly wait for me to go first please mon ami. I like to do some leisurely reading tomorrow and then brew over the charts before taking a view. I'm thinking 1320s at the mo but not final choice just yet.

As for last week I did indicae to Pat 1342 in a repu comment too but he hasn't confirmed.

Perhaps as the competition gets close to the end we should add a rule for the leader to go first where the top contenders are concerned so it's all above board and one is not tail-gaiting just to win competition - not that anyone might think of such a thing other than yours trully 😉

I had a suspicion that it would be a choppy week with it moving sideways but I wasn't really expecting the S&P to behave with quite the volatility it displayed on FOMC day and then the big sell-off on Thursday. The quadruple witching day yesterday turned out to be a damp squib. So it finished on a perfectly 'sideways' 1335.02 or marginally down from last week.

Interestingly there were only 3 people that called a down week and our Robin, Barry and Maurice Gibb for this week are:

1) Atilla - 1342 (6.98)

2) wackypete2 - (-16.02)

3) tar - 1290 (-45.02)

So congrats to our three market falsetto crooners for being about the only people to not go for an up week. :clap::clap::clap:😛😛😛😆😆😆:clover:

Now the leaderboard. There is one week left and Atilla has bagged it looking at the maths. However it could be a joint win if Pete gets the top spot on the podium next week and Atilla fluffs direction. So will Atilla be the lone star of Q2 or will Pete demand the adoration of the crowd too?

Link to full results

Pete,

Kindly wait for me to go first please mon ami. I like to do some leisurely reading tomorrow and then brew over the charts before taking a view. I'm thinking 1320s at the mo but not final choice just yet.

As for last week I did indicae to Pat 1342 in a repu comment too but he hasn't confirmed.

Perhaps as the competition gets close to the end we should add a rule for the leader to go first where the top contenders are concerned so it's all above board and one is not tail-gaiting just to win competition - not that anyone might think of such a thing other than yours trully 😉

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Re: W/E 22nd June - Results

You are bang on the money amigo - lol!!

And I thought I was the only person who used to watch this

You are bang on the money amigo - lol!!

And I thought I was the only person who used to watch this

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Re: W/E 22nd June - Results

😆 It was way ahead of it's time.

Here's a treat...cos it's weekend.

SOAP-CHUCK AND BOB MEET THE FAMILIES. - YouTube

You are bang on the money amigo - lol!!

And I thought I was the only person who used to watch this

😆 It was way ahead of it's time.

Here's a treat...cos it's weekend.

SOAP-CHUCK AND BOB MEET THE FAMILIES. - YouTube

samspade79

Established member

- Messages

- 576

- Likes

- 25

1322

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

As it is getting towards the end of Q2, I was intrigued about the annual tally to (nearly) the half year mark. That too is close:

https://docs.google.com/spreadsheet/ccc?key=0AnFF2Rblu36wdGRNQjNXTzVjdldJb2dXdjRVTGs5VVE#gid=2

https://docs.google.com/spreadsheet/ccc?key=0AnFF2Rblu36wdGRNQjNXTzVjdldJb2dXdjRVTGs5VVE#gid=2

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

1313 for me please Rob.

Either way I am very happy with the results because last time I came first with only 15 points. So as you were saying standard of accuracy and quality of our predictions are certainly improving.

Good luck everyone 👍

If the point was to win at any cost then then I'd have to say up for this week. But, I still believe it's going down so I'll say 1311

I won't win but it was a good fight:clap:

It's nice to see this friendly competition going on for so long 👍

Peter

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

If the point was to win at any cost then then I'd have to say up for this week. But, I still believe it's going down so I'll say 1311

I won't win but it was a good fight:clap:

It's nice to see this friendly competition going on for so long 👍

Peter

I reckon the market is in limbo at the moment with no clear direction either way. The H&S spotted earlier reached it's full conclusion around 1350s and shyed back down again. If 1280s don't hold I have a sneaky feeling some further lows may be tested. I can't see it dropping below 1200s though.

Still too much uncertainty and no concrete news about anything.

On the news; Europe and now ME as well as US elections coupled with Asia slowing down. All a real hotch potch of developments. :whistling Who knows??? 🙄.

Oh and it's summer time with lots of rain here with this weekends concerts a right wash out.

AND England just got kicked out of Euro2012...

Well things can only get better - bring on Wimbledon and the Olympics :clap::clap::clap: 👍

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Predictions for this week

https://docs.google.com/spreadsheet/ccc?key=0AnFF2Rblu36wdGRNQjNXTzVjdldJb2dXdjRVTGs5VVE#gid=0

https://docs.google.com/spreadsheet/ccc?key=0AnFF2Rblu36wdGRNQjNXTzVjdldJb2dXdjRVTGs5VVE#gid=0

hwsteele

Experienced member

- Messages

- 1,227

- Likes

- 182

Sorry for being late to the starting gate this week.

Here is my guess...just kidding.

looks like I won't have that last chance for a first place this quarter, oh well.🙁

I still might make it for the bronze metal, maybe.

My hats off to last weeks winners.

Here is my guess...just kidding.

looks like I won't have that last chance for a first place this quarter, oh well.🙁

I still might make it for the bronze metal, maybe.

My hats off to last weeks winners.

Similar threads

- Replies

- 1K

- Views

- 158K

- Replies

- 1K

- Views

- 184K

- Replies

- 908

- Views

- 132K

- Replies

- 989

- Views

- 133K