You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

S&P 500 cash weekly competition for 2016 with PRIZES!

- Thread starter postman

- Start date

- Watchers 24

Alexander1

Junior member

- Messages

- 25

- Likes

- 0

How can you participate? also want

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

How can you participate? also want

See instructions on post 1.

Forecast what will be the closing price of the S&P 500 at Friday's close.

Do it by 1.30 pm ( GMT ) today.

good luck

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Pound soars after High Court says MPs to vote on Article 50

The pound soared this morning after the High Court in London said the government must consult Parliament before triggering Article 50 – the process to leave the European Union. The stage is now set for a fresh battle over Brexit and there is the prospect that Parliament will block Britain’s withdrawal from the EU.

Cable jumped to above $1.24, its highest in a month, as markets responded instantly to the decision. An appeal is being lodged by the government, meaning this decision is far from final. With increased uncertainty, sterling volatility is expected to remain high.

The pound soared this morning after the High Court in London said the government must consult Parliament before triggering Article 50 – the process to leave the European Union. The stage is now set for a fresh battle over Brexit and there is the prospect that Parliament will block Britain’s withdrawal from the EU.

Cable jumped to above $1.24, its highest in a month, as markets responded instantly to the decision. An appeal is being lodged by the government, meaning this decision is far from final. With increased uncertainty, sterling volatility is expected to remain high.

joseph1986

Experienced member

- Messages

- 1,899

- Likes

- 90

the problem with predicting weekly prices is

1) you can technically get a maximum of 1000 rows of data

2) Most correlated financial instruments have only been introduced after 2005...(Etf's)

The only alternative to that is predicting daily prices one day at a time....time intensive and sometimes it's error prone since you're only dealing with open prices and last day difference. Makes you grateful for intraday fresh prices. Another option would be to cluster the data into up or down and then take that information and predict with a bias of up or down....the problem with this is that the machine is prone to be confused by similar patterns.

1) you can technically get a maximum of 1000 rows of data

2) Most correlated financial instruments have only been introduced after 2005...(Etf's)

The only alternative to that is predicting daily prices one day at a time....time intensive and sometimes it's error prone since you're only dealing with open prices and last day difference. Makes you grateful for intraday fresh prices. Another option would be to cluster the data into up or down and then take that information and predict with a bias of up or down....the problem with this is that the machine is prone to be confused by similar patterns.

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

This weeks guess 2147 please

P

postman

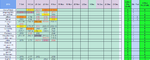

10 people forecasted up and 5 down - so the s&p went down, AGAIN 😱

41 point fall catching out a lot of people.

However, this weeks bright sparks are!

Showing them he's a firework Fairval takes Gold, Katty Perry would be proud.

Shining bright like a diamond, Jeffre has Silver.

Wearing his 'Plain white T's ', WackyPete gets Bronze. (Google it).

41 point fall catching out a lot of people.

However, this weeks bright sparks are!

Showing them he's a firework Fairval takes Gold, Katty Perry would be proud.

Shining bright like a diamond, Jeffre has Silver.

Wearing his 'Plain white T's ', WackyPete gets Bronze. (Google it).

Attachments

P

postman

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

The US Presidential Election is the only show in town this week as markets shift their gaze to the key swing states in what’s become a tighter race than many had expected only a couple of weeks ago.

Markets seem to have priced in a win for Hillary Clinton – which is seen as broadly supportive for equities and the US dollar.

But with the email scandal back in focus Trump could yet emerge as the victor and markets are sensitive to this possibility anew. The VIX ‘fear gauge’, which measures US equity market volatility, has risen from below 13 to around 16 in recent days. Meanwhile the Mexican peso, seen as a proxy trade for the result because of Trump’s desire to rip up Nafta, has fallen since the middle of October.

The election takes place on Tuesday, November 8th, with the result expected to be known by the time European markets open on Wednesday. Traders can expect plenty of volatility as the election nears - the Veterans Day bank holiday on Friday will be a relief.

Markets seem to have priced in a win for Hillary Clinton – which is seen as broadly supportive for equities and the US dollar.

But with the email scandal back in focus Trump could yet emerge as the victor and markets are sensitive to this possibility anew. The VIX ‘fear gauge’, which measures US equity market volatility, has risen from below 13 to around 16 in recent days. Meanwhile the Mexican peso, seen as a proxy trade for the result because of Trump’s desire to rip up Nafta, has fallen since the middle of October.

The election takes place on Tuesday, November 8th, with the result expected to be known by the time European markets open on Wednesday. Traders can expect plenty of volatility as the election nears - the Veterans Day bank holiday on Friday will be a relief.

joseph1986

Experienced member

- Messages

- 1,899

- Likes

- 90

Hi Joseph

$1051153.2 = 73 weeks.

That's a lot of money sport !

Are you telling us, that is your profit in 73 weeks ?

That's my goal for end of 2017, it's actually not a lot of money in my view.

My 10 year goal is 3 billion.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

That's my goal for end of 2017, it's actually not a lot of money in my view.

My 10 year goal is 3 billion.

Well don't forget to send a card from your pte island.

joseph1986

Experienced member

- Messages

- 1,899

- Likes

- 90

Well don't forget to send a card from your pte island.

My hopes aren't that high yet lol

Only mastered one index........ about 10 more to go

Similar threads

- Replies

- 1K

- Views

- 185K

- Replies

- 989

- Views

- 134K

- Replies

- 2K

- Views

- 240K

- Replies

- 908

- Views

- 133K