P

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

S&P 500 cash weekly competition for 2016 with PRIZES!

- Thread starter postman

- Start date

- Watchers 24

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Hope this helps.

THANK YOU!

Much Better for us incompetent members 😱

Peter

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

2038 please

joseph1986

Experienced member

- Messages

- 1,899

- Likes

- 90

😉 2031

P

postman

My forecast 2071.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

This guy gets it right sometimes

--------------------------------------------------------------------------------------------------

Correction over - S&P 500 likely to aim again for 2100

The tide has newly changed. On Thursday, the US stock markets reached their respective daily cycle lows going to bounce up now during two, most likely three week candles (10 to 15 trading days up) until the several time negatively tested strong resistances are worked off resp. reached that result from the all time high and the monthly time frame.

The uptargets of the S&P 500 that are offering themselves resp. can be calculated are: 2083 = minimum uptarget for the coming up cycle, furthermore 2095 and even 2101. 2101 as important uptarget and probable final June 2016 high is downright imposing on us, in my opinion.

After being worked off one June target or all of them - 2083, 2095, 2101 -, the recent after FOMC low at 2026 becomes a critical level. If the market wants to close below the 2026 on weekly closing base from 06/01/2016, some enormous downforces can be unleashed and as a result, an 100, 150 pt. panic down-move might emerge.

The next really important buy signal in the S&P 500 will be triggered only in case the month of June 2016 closes unequivocally above 2096. Such a June buy signal in the monthly time frame would likewise bring to an end the tenacious shoving sideways of the last couple of months, activating 2500 index points till year end 2016.

On 04/24/2016, in the free GUNNER24 Newsletter issue we could state that the S&P 500 had to fall and correct cause the April high reached a main uptarget and starting there enormously strong and important Gann Resistances kicked in.

On 04/24/2016, we furthermore realized that the 2111.05 April high has thoroughly got the potential for being the final high of the year 2016 but that we should work on the assumption of a "moderate" correction move for the time being:

--------------------------------------------------------------------------------------------------

Correction over - S&P 500 likely to aim again for 2100

The tide has newly changed. On Thursday, the US stock markets reached their respective daily cycle lows going to bounce up now during two, most likely three week candles (10 to 15 trading days up) until the several time negatively tested strong resistances are worked off resp. reached that result from the all time high and the monthly time frame.

The uptargets of the S&P 500 that are offering themselves resp. can be calculated are: 2083 = minimum uptarget for the coming up cycle, furthermore 2095 and even 2101. 2101 as important uptarget and probable final June 2016 high is downright imposing on us, in my opinion.

After being worked off one June target or all of them - 2083, 2095, 2101 -, the recent after FOMC low at 2026 becomes a critical level. If the market wants to close below the 2026 on weekly closing base from 06/01/2016, some enormous downforces can be unleashed and as a result, an 100, 150 pt. panic down-move might emerge.

The next really important buy signal in the S&P 500 will be triggered only in case the month of June 2016 closes unequivocally above 2096. Such a June buy signal in the monthly time frame would likewise bring to an end the tenacious shoving sideways of the last couple of months, activating 2500 index points till year end 2016.

On 04/24/2016, in the free GUNNER24 Newsletter issue we could state that the S&P 500 had to fall and correct cause the April high reached a main uptarget and starting there enormously strong and important Gann Resistances kicked in.

On 04/24/2016, we furthermore realized that the 2111.05 April high has thoroughly got the potential for being the final high of the year 2016 but that we should work on the assumption of a "moderate" correction move for the time being:

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

2038 please

NickBk are you copying me again, it didn't do much good last time !! 😆

NickBk are you copying me again, it didn't do much good last time !! 😆

Sorry, I didn't notice and have no memory of a previous time.

Postman 2043 please.

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

Nick you are quite correct, it was TwinToWin who choose the same number a couple of weeks ago. My sincerest apologies. 😱😱

mike.

Senior member

- Messages

- 2,101

- Likes

- 709

Nick you are quite correct, it was TwinToWin who choose the same number a couple of weeks ago. My sincerest apologies. 😱😱

It's to late pingpong, you have severely hurt nicks feelings and put this weeks analysis into total disarray, I'm proposing the very least you can do is donate one of your points to nick as compensation and pray he doesn't take it any further....😆

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

It's to late pingpong, you have severely hurt nicks feelings and put this weeks analysis into total disarray, I'm proposing the very least you can do is donate one of your points to nick as compensation and pray he doesn't take it any further....😆[/QUOTEm]

mike, i'm not that sorry !!! 😆😆

P

postman

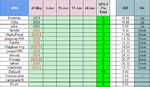

Heres this weeks (Week 9) forecasts.

There are 3 ups and 10 downs so it will be a full podium this week.

A whopping 97 point range, but if you take out TwinToWin the rest of us are in a 50 point range which is more like recent volatility so it should be a close one.

There are 3 ups and 10 downs so it will be a full podium this week.

A whopping 97 point range, but if you take out TwinToWin the rest of us are in a 50 point range which is more like recent volatility so it should be a close one.

Attachments

I see Behzadi thinks 11 will be enough!

What about adding a minimum number of weekly entries to the rules?

Getting a few points and opting out is not in the spirit of competition surely, particularly when they advertise their no selection and fight for the point back and still do not select again, so holidays and my dog ate the mouse wont count.

No pick for over 3 entries -1 anyone?

What about adding a minimum number of weekly entries to the rules?

Getting a few points and opting out is not in the spirit of competition surely, particularly when they advertise their no selection and fight for the point back and still do not select again, so holidays and my dog ate the mouse wont count.

No pick for over 3 entries -1 anyone?

I have just moved to a new flat and that's the reason I was unable to trade or analyse the markets in the last two weeks.

Rules are Rules! You can't change them in the middle of competition.

Yes sure thing.

I have no power to change rules just pointed out the obvious. I do believe I have a right to my own opinion though.

Good to see the 'move' didn't stop you responding to me at 07.06, just stopped your secret spx machine!

Last edited:

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

Thought I'd bagged myself half a point commission then..😆

Don't think Postie does half points 😛😆😆

Similar threads

- Replies

- 1K

- Views

- 185K

- Replies

- 989

- Views

- 134K

- Replies

- 2K

- Views

- 240K

- Replies

- 908

- Views

- 133K