robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

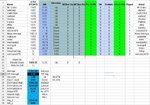

So obviously as the main owner of the sheet, I have the power to revert back to previous revisions.

I can see in the revision history that:

a) Somebody has unhid all the diff columns that I did on Saturday for Q1 '13

b) They have also managed to copy the last 2 weeks of Q1 to the start of the sheet (they haven't gone missing at all).

I will remove the diff columns if they are annoying and also put back the last 2 weeks of Q1 in there correct place.

I can restrict access to the sheet to named individuals. Let me know if you want to do this and I can arrange.

I can see in the revision history that:

a) Somebody has unhid all the diff columns that I did on Saturday for Q1 '13

b) They have also managed to copy the last 2 weeks of Q1 to the start of the sheet (they haven't gone missing at all).

I will remove the diff columns if they are annoying and also put back the last 2 weeks of Q1 in there correct place.

I can restrict access to the sheet to named individuals. Let me know if you want to do this and I can arrange.