Z Forex

Established member

- Messages

- 805

- Likes

- 1

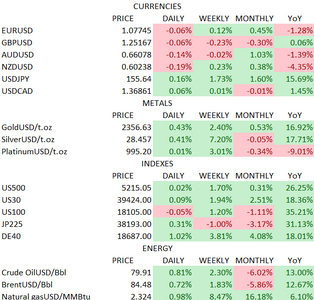

US Indices

S&P 500 and Nasdaq Futures Dip & Corporates Fluctuate

S&P 500 futures declined by 0.5%, and Nasdaq 100 futures fell by 0.9% as the market braces for the upcoming U.S. consumer inflation report. Economists anticipate the January U.S. CPI to show a monthly increase of 0.2% and an annual rise of 2.9%, a slight deceleration from the previous figures of 0.3% month-on-month and 3.4% year-on-year.

The U.S. stock market faces a significant test today with the release of this economic data, following a robust three-month rally. During this period, mega-cap companies, particularly those in the AI sector, have driven the market to reach new historic highs.

A Bank of America survey indicated that its "Bull & Bear Indicator" has climbed to 6.8, signaling that investor positioning may increasingly pose a challenge for risk assets.

On the corporate side, NVIDIA saw a nearly 1% drop in premarket trading, while Coca-Cola experienced a slight increase of 0.3% after announcing earnings that met expectations and revenue that exceeded them.

The Nasdaq has hit a resistance level at 18000, where it touches the upper parallel of the long-term bullish channel. Today's economic data will mostly influence the performance and direction of the index and could lead to a correction or a breakout considering the current overbought conditions.

Crypto

Bitcoin Tops $50,000 Amid Bullish Sentiment of Traders

Bitcoin's price action has been the center of attention as it soared above the $50,000 mark, a level not seen since December 2021. This rally was partly fueled by the anticipation of a rate cut by the US Federal Reserve, the growing popularity of Bitcoin ETFs, and the upcoming Bitcoin Halving event in April 2024, which historically tends to push the cryptocurrency market to new highs.

Traders have shown bullish sentiment, as evidenced by the increased open interest in Bitcoin and the forced liquidation of short positions when the price broke beyond $49,000. The market's bullish momentum is further supported by the fact that Bitcoin has positioned itself above its 50-day moving average.

The surge in Bitcoin's price has led to a rise in speculative activities, with traders on prediction platforms like Polymarket making significant gains. For instance, a trader made a 550% return betting on Bitcoin's price reaching $50,000 in February. Moreover, options traders are scooping up bets at $65K and higher, reflecting strong bullish market sentiment.

Despite the positive trends, there are concerns about overbought conditions and potential market impacts from the forced sale of cryptocurrencies by the failed lender Genesis. Nonetheless, the market outlook remains optimistic, with forecasts suggesting a continued rise in Bitcoin's value.

S&P 500 and Nasdaq Futures Dip & Corporates Fluctuate

S&P 500 futures declined by 0.5%, and Nasdaq 100 futures fell by 0.9% as the market braces for the upcoming U.S. consumer inflation report. Economists anticipate the January U.S. CPI to show a monthly increase of 0.2% and an annual rise of 2.9%, a slight deceleration from the previous figures of 0.3% month-on-month and 3.4% year-on-year.

The U.S. stock market faces a significant test today with the release of this economic data, following a robust three-month rally. During this period, mega-cap companies, particularly those in the AI sector, have driven the market to reach new historic highs.

A Bank of America survey indicated that its "Bull & Bear Indicator" has climbed to 6.8, signaling that investor positioning may increasingly pose a challenge for risk assets.

On the corporate side, NVIDIA saw a nearly 1% drop in premarket trading, while Coca-Cola experienced a slight increase of 0.3% after announcing earnings that met expectations and revenue that exceeded them.

The Nasdaq has hit a resistance level at 18000, where it touches the upper parallel of the long-term bullish channel. Today's economic data will mostly influence the performance and direction of the index and could lead to a correction or a breakout considering the current overbought conditions.

Crypto

Bitcoin Tops $50,000 Amid Bullish Sentiment of Traders

Bitcoin's price action has been the center of attention as it soared above the $50,000 mark, a level not seen since December 2021. This rally was partly fueled by the anticipation of a rate cut by the US Federal Reserve, the growing popularity of Bitcoin ETFs, and the upcoming Bitcoin Halving event in April 2024, which historically tends to push the cryptocurrency market to new highs.

Traders have shown bullish sentiment, as evidenced by the increased open interest in Bitcoin and the forced liquidation of short positions when the price broke beyond $49,000. The market's bullish momentum is further supported by the fact that Bitcoin has positioned itself above its 50-day moving average.

The surge in Bitcoin's price has led to a rise in speculative activities, with traders on prediction platforms like Polymarket making significant gains. For instance, a trader made a 550% return betting on Bitcoin's price reaching $50,000 in February. Moreover, options traders are scooping up bets at $65K and higher, reflecting strong bullish market sentiment.

Despite the positive trends, there are concerns about overbought conditions and potential market impacts from the forced sale of cryptocurrencies by the failed lender Genesis. Nonetheless, the market outlook remains optimistic, with forecasts suggesting a continued rise in Bitcoin's value.