Z Forex

Established member

- Messages

- 805

- Likes

- 1

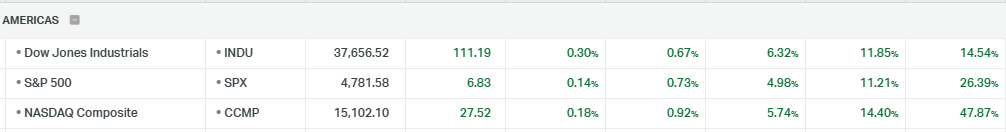

US INDICES:

U.S. Stock Futures Decline as Moody's Downgrades Credit Outlook

U.S. stock futures experienced a decline on Monday following Moody's Investors Service's decision to downgrade the U.S. credit outlook from stable to negative. This interruption comes after two weeks of strong performance that had offset much of the losses incurred over the past three months.

Moody's decision, driven by large fiscal deficits and political deadlock in Washington, maintains the AAA credit rating but highlights fiscal concerns. This development echoes Fitch's earlier downgrade of the U.S. long-term foreign currency issuer default rating to AA+ over similar issues.

Investors now turn their focus to October's federal budget and the New York Fed's consumer expectations survey, with Fed Governor Lisa Cook set to speak Monday morning, all preceding Tuesday's crucial consumer price index data release.

The Nasdaq continues to exhibit strong momentum, with the potential for the next high at 16000. However, the upcoming CPI data on Tuesday warrants careful observation.

Crypto

Spot Bitcoin ETF Approval Imminent, Fueling Crypto Market Surge

Pro-Bitcoin ETF expert Nate Geraci has suggested the possibility of approval for a spot Bitcoin ETF this week, aligning with Bloomberg's ETF analyst and sparking widespread interest. This development comes after a series of delays in spot Bitcoin ETF applications since June 2023, including Grayscale's application, which was initially rejected and is now undergoing re-review by the SEC.

BlackRock recently challenged the SEC's differing treatment of spot-crypto and crypto-futures ETF applications, advocating for consistent standards, especially in light of their spot-Ether ETF proposal. Following these developments, Todayq News reported a high likelihood of the SEC approving all 12 pending Bitcoin ETF applications soon. This optimism has buoyed the cryptocurrency market, with Bitcoin's price notably crossing the $37,000 mark for the first time since May 2022, following a 25% surge in the last three weeks.

Bitcoin is currently undergoing a bullish breakout, propelling its price toward the 46700 area - the next target. Sustaining this upward trend by the end of the week would signal a long-term bullish trend and suggest an opportune time to consider buying.

U.S. Stock Futures Decline as Moody's Downgrades Credit Outlook

U.S. stock futures experienced a decline on Monday following Moody's Investors Service's decision to downgrade the U.S. credit outlook from stable to negative. This interruption comes after two weeks of strong performance that had offset much of the losses incurred over the past three months.

Moody's decision, driven by large fiscal deficits and political deadlock in Washington, maintains the AAA credit rating but highlights fiscal concerns. This development echoes Fitch's earlier downgrade of the U.S. long-term foreign currency issuer default rating to AA+ over similar issues.

Investors now turn their focus to October's federal budget and the New York Fed's consumer expectations survey, with Fed Governor Lisa Cook set to speak Monday morning, all preceding Tuesday's crucial consumer price index data release.

The Nasdaq continues to exhibit strong momentum, with the potential for the next high at 16000. However, the upcoming CPI data on Tuesday warrants careful observation.

Crypto

Spot Bitcoin ETF Approval Imminent, Fueling Crypto Market Surge

Pro-Bitcoin ETF expert Nate Geraci has suggested the possibility of approval for a spot Bitcoin ETF this week, aligning with Bloomberg's ETF analyst and sparking widespread interest. This development comes after a series of delays in spot Bitcoin ETF applications since June 2023, including Grayscale's application, which was initially rejected and is now undergoing re-review by the SEC.

BlackRock recently challenged the SEC's differing treatment of spot-crypto and crypto-futures ETF applications, advocating for consistent standards, especially in light of their spot-Ether ETF proposal. Following these developments, Todayq News reported a high likelihood of the SEC approving all 12 pending Bitcoin ETF applications soon. This optimism has buoyed the cryptocurrency market, with Bitcoin's price notably crossing the $37,000 mark for the first time since May 2022, following a 25% surge in the last three weeks.

Bitcoin is currently undergoing a bullish breakout, propelling its price toward the 46700 area - the next target. Sustaining this upward trend by the end of the week would signal a long-term bullish trend and suggest an opportune time to consider buying.