Omni,

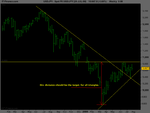

You should read Marber's book on trading markets. He has some useful if not overly technical ways of trading the break outs. In a Triangle formation you would place your entry just above where the 2nd hit of your TL is for a long, or 2nd hit on a TL for a short. He also advocates a 3% stocks, 1% Forex Breakout for it to be confirmed as a TL break.

He seems to hate day trading prefering the longer TFs of daily and weekly. His overarching method is to stick with the trend; the secret is the confirmation of the trend. He shows a forex chart with 6 indicators all giving various buy/sell signals that over a 6 month period woud have you in and out of the market 15 times. He then shows you a simple monthly MA that would have kept you in the market and with the trend for all of those 15 indicator signals!

It seems that the simple uncomplicated methods are often the best..

Grim