Depth Trade

Experienced member

- Messages

- 1,848

- Likes

- 99

Hello fellow traders, here is a strategy that someone could possibly profit from again in the future. If one had been trading it past few weeks, using my positions for trend direction. I think one could have made quite a few dollars the past weeks.

This trade should be taken whenever the 'setup' occurs, even after failure has just happened.

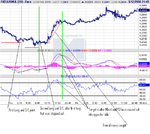

I recommend that one waits for FX pair to pull back of current direction into RSI '70/30', then enter position as MACD closes across from recent extreme.

Please see chart for further review.

Have entered following postions.

Aud/usd Long .7734

s/l .7633

Cad/jpy Short 99.15

s/l 101.85

Eur/cad Long 1.4344

s/l 1.3998

Eur/usd Long 1.2932

s/l 1.2662

Gbp/usd Long 1.8949

s/l 1.8515

Usd/chf Short 1.1970

s/l 1.2319

Usd/jpy Short 109.98

s/l 112.61

T2W thread, -2.04 %, ^04/09/05

🙂

This trade should be taken whenever the 'setup' occurs, even after failure has just happened.

I recommend that one waits for FX pair to pull back of current direction into RSI '70/30', then enter position as MACD closes across from recent extreme.

Please see chart for further review.

Have entered following postions.

Aud/usd Long .7734

s/l .7633

Cad/jpy Short 99.15

s/l 101.85

Eur/cad Long 1.4344

s/l 1.3998

Eur/usd Long 1.2932

s/l 1.2662

Gbp/usd Long 1.8949

s/l 1.8515

Usd/chf Short 1.1970

s/l 1.2319

Usd/jpy Short 109.98

s/l 112.61

T2W thread, -2.04 %, ^04/09/05

🙂