You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

'No indicators' revisited

- Thread starter ford

- Start date

- Watchers 53

MysticalTrader

Active member

- Messages

- 165

- Likes

- 1

No, really, I am not enjoying your discomfort. I am sorry this appears to have come as a shock, I really thought most people already knew.

And I do assure you I am nothing to do with Socrates, I don't know the man I promise you.

LOL, who on earth thought I was him? Crikey, tht's a discomforting thought!

MT

And I do assure you I am nothing to do with Socrates, I don't know the man I promise you.

LOL, who on earth thought I was him? Crikey, tht's a discomforting thought!

MT

harryp said:You're enjoying my discomfort ................. and do'nt pretend you're not !

It has even been suggested to me that you are one of his other personae ?

Nothing would surprise me after todays revelations !

MysticalTrader

Active member

- Messages

- 165

- Likes

- 1

hrmmm Maybe. Maybe not.

Anyway, things to do...

MT

Anyway, things to do...

MT

harryp said:Now you're rubbing salt into this terrible wound ...................... you see this is the whole point ........................everybody AND their personas knew all along .................

I feel so foolish

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Skimbleshanks said:Darktone, it's nice to see that with a bit of luck this thread is back to pure price action. And nice analysis of the chart. A question, if I may. How do you define your RB?

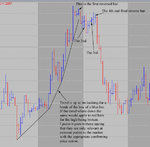

Heres a brief discription.

cheers

dt

Attachments

neil

Legendary member

- Messages

- 5,169

- Likes

- 754

darktone said:Heres a brief discription.

cheers

dt

Your first reversal bar - did you have a volume bar to go with it....higher/lower volume for example?

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

neil said:Your first reversal bar - did you have a volume bar to go with it....higher/lower volume for example?

hello neil

no volume, the instrument was USD/CHF spot.

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

DT - not getting this at all.

If you're looking for a bar with a low lower than any previous blue bar it occurs much earlier than you indicate. There's a red bar sandwiched between two blues just after your pointer describing the trend (or dees the lower bar have to be blue also?). Plus, you're first highlighted reversal bar doesn't seem to meet the criteria you state. It isn't a lower low.

As I say, I'm probably not getting this.

If you're looking for a bar with a low lower than any previous blue bar it occurs much earlier than you indicate. There's a red bar sandwiched between two blues just after your pointer describing the trend (or dees the lower bar have to be blue also?). Plus, you're first highlighted reversal bar doesn't seem to meet the criteria you state. It isn't a lower low.

As I say, I'm probably not getting this.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

TheBramble said:DT - not getting this at all.

If you're looking for a bar with a low lower than any previous blue bar it occurs much earlier than you indicate. There's a red bar sandwiched between two blues just after your pointer describing the trend (or dees the lower bar have to be blue also?). Plus, you're first highlighted reversal bar doesn't seem to meet the criteria you state. It isn't a lower low.

As I say, I'm probably not getting this.

hello Bramble

Ive highlighted the bars that have been 'reversed' by the following bar, the first highlighted blue bar has been broken to the downside by the following red bar but i went on say that it doesnt matter how the 'breaking' bar closes, it just happens that this this bar closed lower (red, the 4th was broken by a bar that closed up / blue), Also im only interested in bars in keeping with the trend ie. if the trend is up i look for blue bars to have their lows broken.

Im not saying that a bar like this should be acted on straight away but it shows that weakness is starting to take hold. Its should only be used to confirm and trigger thoughts taken on larger time frames.

regards

dt

growltiger

Member

- Messages

- 91

- Likes

- 0

Reversal puzzle

That's very clear and helfpul. I still don't understand how the "3rd reversed bar" fits the pattern. Could you bear to have another go?

darktone said:hello Bramble

Ive highlighted the bars that have been 'reversed' by the following bar, the first highlighted blue bar has been broken to the downside by the following red bar but i went on say that it doesnt matter how the 'breaking' bar closes, it just happens that this this bar closed lower (red, the 4th was broken by a bar that closed up / blue), Also im only interested in bars in keeping with the trend ie. if the trend is up i look for blue bars to have their lows broken.

Im not saying that a bar like this should be acted on straight away but it shows that weakness is starting to take hold. Its should only be used to confirm and trigger thoughts taken on larger time frames.

regards

dt

That's very clear and helfpul. I still don't understand how the "3rd reversed bar" fits the pattern. Could you bear to have another go?

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

darktone

Interesting (but maybe a bit off "no indicator" piste) that the swing method I use eod would have been ok here.

If the previous trend had been up it would have been reversed by the long down bar at 28th and the first swing high came 5 bars later. I would have taken a short position at around 2500 but been stopped out when the swing high was breached at 2520 when I would have entered a half position long. The first swing low came at your 2 where I would have made up to a full position at around 2575. The next swing low was by your 4 and I would have closed and entered half position short when this was breached around 2620.

Trying to find the first swing high would have been messy. The reaction to around 2540 was only a single higher high and I would have probably thought the first swing high was coming at around 2530 (blue bar above Jul) and I might have been tempted to make up short to a full position here on the subsequent down bar around 2515. My whole position would then have been stopped out at around 2535.

Interesting (but maybe a bit off "no indicator" piste) that the swing method I use eod would have been ok here.

If the previous trend had been up it would have been reversed by the long down bar at 28th and the first swing high came 5 bars later. I would have taken a short position at around 2500 but been stopped out when the swing high was breached at 2520 when I would have entered a half position long. The first swing low came at your 2 where I would have made up to a full position at around 2575. The next swing low was by your 4 and I would have closed and entered half position short when this was breached around 2620.

Trying to find the first swing high would have been messy. The reaction to around 2540 was only a single higher high and I would have probably thought the first swing high was coming at around 2530 (blue bar above Jul) and I might have been tempted to make up short to a full position here on the subsequent down bar around 2515. My whole position would then have been stopped out at around 2535.

Last edited:

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

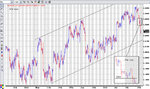

Interesting (but maybe a bit off "no indicator" piste) that the swing method I use eod would have been ok here.

hello barjon

hmm very interesting, hows it do with smaller time scales? the style ive posted can get quite noisy and easy to overtrade if your not carefull 😱 🙄

Heres and example today which didnt work out as planned, it was a long in E$.

chart below.

regards

dt

Attachments

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

DT - at what point did you go Long - and what was your rationale?

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

TheBramble said:DT - at what point did you go Long - and what was your rationale?

hello Bramble

Limit buy @ 2319 after the 4th RB and confirmed support at 2300, stop @ 2299, 4 hr chart deeply oversold relative to recent price action and overall trend up in daily/weekly.

Looks like it will test the lower range of channel or weekly trend that sits just below, failure of these threatens LT E/$ bull.

So out for now and waiting for decent chance to get long.

all IMHO

regards

dt

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

Why aren't you looking for deeply oversold at 2455?darktone said:Limit buy @ 2319 after the 4th RB and confirmed support at 2300, stop @ 2299, 4 hr chart deeply oversold relative to recent price action and overall trend up in daily/weekly.

Surely anything above 2185 indicates a bullish move within the existing channel?darktone said:Looks like it will test the lower range of channel or weekly trend that sits just below, failure of these threatens LT E/$ bull.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Why aren't you looking for deeply oversold at 2455?

because 2455 isnt at all oversold on the 4hr chart.

Surely anything above 2185 indicates a bullish move within the existing channel?

? not really sure i understand what you mean by that. Id like to see to prices hold within the channel and look for decent 1hr price action.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

darktone

Works on smaller timescales after a fashion - as with anything the smaller the timescale the greater the noise and the greater potential for confusion!!

If you're working a channel isn't it a touch dangerous to enter in mid stream? Longs in the bottom quartile and shorts in the top quartile are the safer orders of the day?

Works on smaller timescales after a fashion - as with anything the smaller the timescale the greater the noise and the greater potential for confusion!!

If you're working a channel isn't it a touch dangerous to enter in mid stream? Longs in the bottom quartile and shorts in the top quartile are the safer orders of the day?

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

If you're working a channel isn't it a touch dangerous to enter in mid stream? Longs in the bottom quartile and shorts in the top quartile are the safer orders of the day?

Im not really working the channel as such, my intentions are more to build a long position. Due to the time scale i work i cant really agree with taking shorts at the top of a rising channel but that is only because of the style i adopt, i know plenty o folk that do 😉 . IMHO channels are there to be noted but exist to be broken. Oversold and price conditions were met so i acted and protected.

was it? it cost me 20 pips for the possibility of a long position move. That doesnt sound dangerous to me, to still be holding and hoping may be dangerous though.dangerous

cheers

dt

Similar threads

- Replies

- 1

- Views

- 5K

- Replies

- 0

- Views

- 2K

- Replies

- 412

- Views

- 93K