I usually look at ES, COMPX, and Dow, in other words one from each of the three main indices. It doesn't really matter which ones, it could be NDX (Nasdaq 100) or NQ, and SPX or INX, you just need to know when one is out of sync with the others. When that happens the laggard will either have to catch up with the other two, or it will pull the others down with it. So you keep your eye on the laggard.

Yesterday in the ones I watch the laggard was COMPX. In other words, Nasdaq was bearish when the S&P and Dow were bullish. So by watching the Nasdaq you would know what was likely to happen. If it got bullish then up we went, if it continued to be bearish then down we went.

There is never one index which leads - they take it in turns, both throughout the day and overall.

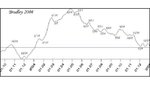

I'll illustrate what I mean. The following are the three markets for the same period yesterday, all on the 5 minute charts.

I've adjusted the charts so that they are all the same size, and the move from A to B is the same on each chart - in other words, they're as close as I can get to being equal, so that you can see the differences.

I've marked four points - A, B, C, D - and if you look at the relative positioning of them you can see which is leading the others.

At points A and B the markets were in sync. But at point C at around 11:15, the Dow was leading, S&P was in the middle and Nasdaq was lagging. The Nasdaq was considerably bearish. Point D is above point B on both the Dow and the S&P, but it was below point B on the Nasdaq. So the Nasdaq has gone from being considerably bearish to being exceedingly bearish.

This shows you the set-up, prior to what was a big drop. So you know to be exceedingly careful with any longs in the afternoon session as shorts are the order of the day.

No messy calculations, just open your eyes and look! LOL