You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Two opportunities I did not take. 1 because I was too late and second because I was not following my system and this is one of the first times I err on the side of being too prudent. I made them into virtual trades.

Long NASDAQ-100

Net P/L +3.12 points

Amount: 1 contract

Opening Rate 5247.90 (spread of 1.50 not counted)

Close Rate 5252.52 (spread of 1.50 not counted)

Open Time 2/14/2017 4:09 PM

Close Time 2/9/2017 4:12 PM

Stop loss: fixed stop below lowest low (trailing stop at 4:10)

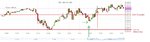

Entry and exit on a 1m chart (second trade also included in this chart

Reason of closure: trailing SL got hit

Comments

Virtual trade. Fast move up, should move to trailing SL when nearing the 5252.35 level which would have gotten me stopped out around the red arrow.

Long NASDAQ-100

Net P/L +3.12 points

Amount: 1 contract

Opening Rate 5247.90 (spread of 1.50 not counted)

Close Rate 5252.52 (spread of 1.50 not counted)

Open Time 2/14/2017 4:09 PM

Close Time 2/9/2017 4:12 PM

Stop loss: fixed stop below lowest low (trailing stop at 4:10)

Entry and exit on a 1m chart (second trade also included in this chart

Reason of closure: trailing SL got hit

Comments

Virtual trade. Fast move up, should move to trailing SL when nearing the 5252.35 level which would have gotten me stopped out around the red arrow.

Short NASDAQ-100

Net P/L +7.52 points

Amount: 1 contract

Opening Rate 5251.00 (spread of 1.50 not counted, is counted in result however)

Close Rate 5241.98 (spread of 1.50 not counted, is counted in result however)

Open Time 2/14/2017 4:24 PM

Close Time 2/14/2017 4:38 PM

Stop loss: fixed stop above highest high (trailing stop at 4:36)

Entry and exit on a 1m chart (second set of arrows)

Reason of closure: trailing SL got hit

Comments

Virtual trade. Did not enter because I thought situation stunk.... but I should just enter if it is according to the system. Even if a nearby level is there. I know it's not good but I have not incorporated that yet so I should psychologically learn to just enter and follow the system.

I guess I am afraid to mess my statistics up and to fail to have found a good system. It does make A LOT of sense to incorporate it though but I don't want to change it too soon either hhmmmmmm, I will have to ponder what is best to do. It also makes no sense to not take these trades because I know it is bad but to leave it out the system. Might as well include it then. On the other hand I should learn to just follow the system, albeit it's not complete yet in my opinion. I guess I will do that for a while since I feel that is more important right now. IF and that is IF I find a system that proves to be profitable on demo and I take it live I also have to be able to follow it mechanically else mistakes will be made and doubt will creep in etc etc.

Net P/L +7.52 points

Amount: 1 contract

Opening Rate 5251.00 (spread of 1.50 not counted, is counted in result however)

Close Rate 5241.98 (spread of 1.50 not counted, is counted in result however)

Open Time 2/14/2017 4:24 PM

Close Time 2/14/2017 4:38 PM

Stop loss: fixed stop above highest high (trailing stop at 4:36)

Entry and exit on a 1m chart (second set of arrows)

Reason of closure: trailing SL got hit

Comments

Virtual trade. Did not enter because I thought situation stunk.... but I should just enter if it is according to the system. Even if a nearby level is there. I know it's not good but I have not incorporated that yet so I should psychologically learn to just enter and follow the system.

I guess I am afraid to mess my statistics up and to fail to have found a good system. It does make A LOT of sense to incorporate it though but I don't want to change it too soon either hhmmmmmm, I will have to ponder what is best to do. It also makes no sense to not take these trades because I know it is bad but to leave it out the system. Might as well include it then. On the other hand I should learn to just follow the system, albeit it's not complete yet in my opinion. I guess I will do that for a while since I feel that is more important right now. IF and that is IF I find a system that proves to be profitable on demo and I take it live I also have to be able to follow it mechanically else mistakes will be made and doubt will creep in etc etc.

Long NASDAQ-100

Net P/L +3.24 points

Amount: 1 contract

Opening Rate 5306.77

Close Rate 5310.1

Open Time 2/16/2017 4:12 PM

Close Time 2/16/2017 4:37 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 1m chart

Reason of closure: tightened trailing SL got hit

Comments

Followed the system to the letter as mentioned. I did not care that there was a nearby S&R line because system does not mention it. Tightened the SL only when near the 5311.85 level which indeed once again seems to check out. I can be short about this one: Good trade!

Net P/L +3.24 points

Amount: 1 contract

Opening Rate 5306.77

Close Rate 5310.1

Open Time 2/16/2017 4:12 PM

Close Time 2/16/2017 4:37 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 1m chart

Reason of closure: tightened trailing SL got hit

Comments

Followed the system to the letter as mentioned. I did not care that there was a nearby S&R line because system does not mention it. Tightened the SL only when near the 5311.85 level which indeed once again seems to check out. I can be short about this one: Good trade!

Preparation 17-02-2017

View attachment 234192

Do you know brokers that offer trading on Nasdaq for non US traders? I trade it with Нotforex as CFD but want to try exchange traded contracts too.

Do you know brokers that offer trading on Nasdaq for non US traders? I trade it with Нotforex as CFD but want to try exchange traded contracts too.

I trade it with plus500 also as CFD (demo only atm). But they took away all leverage so it's not really interesting to trade anymore plus the spread is really bad there. Not really recommendable but good enough to demo on.

You say you trade it on H otforex as CFD? Is there any leverage involved and how is the spread there?

Long NASDAQ-100

Net P/L -8.81 points

Amount: 1 contract

Opening Rate 5347.03

Close Rate 5338.22

Open time 2/23/2017 4:00 PM

Close Time 2/23/2017 4:09 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 5m(!) chart

Reason of closure: SL got hit

Comments

Was too late in getting the data so I only have a 5 min chart instead of a 1m chart. Can't really see anything on it except for the big move down and then a retracement up. What isn't visible is that it retraced down again and then went back up beating the previous high. Which is a trigger for me to take a long position. Which obviously failed miserably. Price bounced off the 5345.85 level. In terms of executing exactly like the system I did good.

What could be done better in the future (if I change the system) is that with really big moves like this to wait a bit longer and to redefine retracements, I was watching the 1min chart so acted a bit too fast and mistook "noise" for my signal. On this 5m chart I would not have entered at all just looking at that. I mentioned something exactly like this before, it was exactly the same situation

Another thing I COULD incorporate is to NOT take a position in the direction of a closeby S&R level.

For now let's keep the system as is.

Net P/L -8.81 points

Amount: 1 contract

Opening Rate 5347.03

Close Rate 5338.22

Open time 2/23/2017 4:00 PM

Close Time 2/23/2017 4:09 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 5m(!) chart

Reason of closure: SL got hit

Comments

Was too late in getting the data so I only have a 5 min chart instead of a 1m chart. Can't really see anything on it except for the big move down and then a retracement up. What isn't visible is that it retraced down again and then went back up beating the previous high. Which is a trigger for me to take a long position. Which obviously failed miserably. Price bounced off the 5345.85 level. In terms of executing exactly like the system I did good.

What could be done better in the future (if I change the system) is that with really big moves like this to wait a bit longer and to redefine retracements, I was watching the 1min chart so acted a bit too fast and mistook "noise" for my signal. On this 5m chart I would not have entered at all just looking at that. I mentioned something exactly like this before, it was exactly the same situation

Another thing I COULD incorporate is to NOT take a position in the direction of a closeby S&R level.

For now let's keep the system as is.

Short NASDAQ-100

Net P/L -15.17 points

Amount: 1 contract

Opening Rate 5309.98

Close Rate 5325.15

Open time 2/24/2017 4:12 PM

Close Time 2/24/2017 5:12 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Nice big move, nice big loss. Traded as I was supposed to according to the system. However most of the move down as reaction to the big move up had already happened before I was allowed to take a position. That is relatively speaking cause in absolute points it was still 4 points away from the support level, which is enough to yield a medium profit. Relatively seen it was pretty close though.

Two things strike me as to how I could improve the system.

1) What I said above, and mentioned in my last post too, not taking a position in the direction close of that of an S&R line (would limit the nr of trades even more)

2) The first peak just before 15:45 is the move I am playing. Then comes the move down, and then the retracement of that move down which makes a higher high at 16:00. Which kind of implies that it is not a retracement but still part of the move. Which gets confirmed because it bounced off the predefined resistance level of 5323.35. I could add a rule not to take a position when the "retracement" makes a higher high or lower low for the reasons I stated above. I am leaning more towards this second point because it seems to make sense in the context.

Also I probably should have put a trailing SL near the lowest low a bit after 16:15

Net P/L -15.17 points

Amount: 1 contract

Opening Rate 5309.98

Close Rate 5325.15

Open time 2/24/2017 4:12 PM

Close Time 2/24/2017 5:12 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Nice big move, nice big loss. Traded as I was supposed to according to the system. However most of the move down as reaction to the big move up had already happened before I was allowed to take a position. That is relatively speaking cause in absolute points it was still 4 points away from the support level, which is enough to yield a medium profit. Relatively seen it was pretty close though.

Two things strike me as to how I could improve the system.

1) What I said above, and mentioned in my last post too, not taking a position in the direction close of that of an S&R line (would limit the nr of trades even more)

2) The first peak just before 15:45 is the move I am playing. Then comes the move down, and then the retracement of that move down which makes a higher high at 16:00. Which kind of implies that it is not a retracement but still part of the move. Which gets confirmed because it bounced off the predefined resistance level of 5323.35. I could add a rule not to take a position when the "retracement" makes a higher high or lower low for the reasons I stated above. I am leaning more towards this second point because it seems to make sense in the context.

Also I probably should have put a trailing SL near the lowest low a bit after 16:15

Short NASDAQ-100

Net P/L -9.67 points

Amount: 1 contract

Opening Rate 5327.35

Close Rate 5337.03

Open time 2/27/2017 4:19 PM

Close Time 2/27/2017 4:27 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Followed the system. Legitimate loser. Not much more to say here.

Net P/L -9.67 points

Amount: 1 contract

Opening Rate 5327.35

Close Rate 5337.03

Open time 2/27/2017 4:19 PM

Close Time 2/27/2017 4:27 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Followed the system. Legitimate loser. Not much more to say here.

No trade so far. Below is a 1m chart attached, according to my system price should have passed the orange line at the orange arrow. It did not do so so I did not enter. Price got tested three times at the orange line, which would indicate going short. However not part of the system so I abstained from that.

Oh that orange line also happened to be my support line from the preparation....

Oh that orange line also happened to be my support line from the preparation....

Similar threads

- Replies

- 817

- Views

- 85K

- Replies

- 152

- Views

- 51K

- Replies

- 0

- Views

- 2K