moving average working

http://chartgame.com/trackrecord.cgi?ew6cuy-16,109

http://chartgame.com/trackrecord.cgi?ew6cuy-16,109

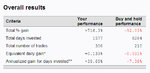

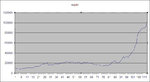

After 154 trades and bringing 10k to 80k, I can say that using the moving average (roughly from 20 to 40 periods on the daily candles) as a signal for entries and exits works.

The method is the one used above, but I can also enter repeatedly for every stock.

The method again is this:

Enter with ma in favor (usually at crossover) in extremely overstretched situations. You don't have to trade every chart.

Exit if the whole candle is on the other side of average - otherwise discretionary exit, usually before it gets recrossed, because I'd rather have more wins and smaller than huge wins and less frequent. I have troubles taking losses.

Having a moving average there, constantly reminding you when you're wrong and the trade is against you, is a good protection against my denial tendencies.

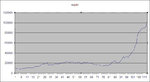

This above is my equity after bringing 10k to 100k (I traded more). I am getting used to my medecine of the moving average. It cures me from being in denial and not taking losses. But it still hasn't become second nature.

It's going to be close to impossible to lose 100k now. But, knowing my tendency to not take losses, I know could lose it all in just two trades. I could lose 90% in one trade actually. It's pretty easy to lose in one trade everything you have made in 150 trades.

One could say that it's just as easy to make money as it is to lose it. And it's true (if we exclude commissions and spread costs). However, with my help, or rather my damage, it is far easier to lose it. You see, if I pressed buy and sell randomly, the outcome would be random, and I could turn 10k into 100k in one trade just as easily as I could turn 10k into 1k. Say you sell something at 10 and it goes to 1. You bring 10k to 100k. Now say you push the opposite button and buy at 10 and it goes to 1. I am tired but more or less you would bring your capital from 10k to 1k (this part for sure, the other part, I am less sure about).

So we know that random trades give you zero profit in the long run (no costs in the chart game). But why do my trades bring me losses and bigger losses than wins? Because I cut wins and let losses run. So that if I don't protect myself from those big losses, I am screwed. I cut wins because I don't they'll be long term wins. The uncertainty is too much to risk it. But then I don't cut losses because I am hoping they will come back. So a loss can turn into a big loss, but a win cannot do the same.

I am tired, but I get my point. I am just talking to myself, because this is discretionary stuff, so I am not going to debate this stuff, as I said several times before.

Bottom line is that I can make money with discretionary trading, as long as I keep myself tied to a moving average which will force me to get out of a losing trade.

---------------------

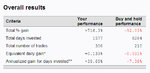

Nothing to do, it's hopeless:

http://chartgame.com/trackrecord.cgi?ew6cuy-16,164

After a while I get tired, get restless, and overdo it... expecting to still make money. Just like with my real account. And I lose. I don't close a losing trade... I blow out both my real account and my simulated account, out of impatience.

I am definitely capable of making money, but the more I play the more impatient I get, so I should just weigh my choices. On the other hand, I must make sure that I get so good and develop such a profitable method that I will be able to make money no matter what stock I play, any stock. Not just out of every 10, but out of every single stock. Provided that I am rested and that I have the choice of not trading a stock. And provided that I can play on a daily basis (on the chart game).