Things aren't going too well, today. Didn't get much done, didn't understand much of what i did, the neighbor bitch kept slamming her door endlessly today - may she die.

But I am going to trust in this song:

Judy Garland - Over The Rainbow (Subtitiles) - YouTube

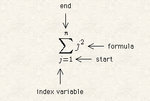

She has something of norah jones. I believe that somewhere, over the rainbow, there's understanding for me. Understanding of formulas, and the markowitz mother ****er, and all his academic buddies and their summation ****ing notation.

Here's the daughter of Judy Garland:

Liza Minnelli & Pavarotti - "New York, New York" - YouTube

I have nothing against her, except that she's been singing that same song for too long.

Somewhere over the Rainbow (solo Guitar) Jose Feliciano - YouTube

What do we know about Jose Feliciano? That we like how he plays guitar... but maybe also that he's blind. If he weren't blind, we might think he's not as good a guitar player. If he weren't blind anymore, he would lose all his fame, as he would not be Jose Feliciano anymore, but just some unknown guy in the subway.

Norah Jones - Somewhere over the Rainbow - What A Wonderful World - YouTube

What do we know about Norah Jones? That she's hot. We don't know if we actually like her only because she sings well. If she were 90 years old, we might not like her as much. Feliciano instead, we know we don't like him for his looks.

I am really thinking about the princess of alba, the duchess, that lady from the previous post. Why was everyone admiring her? Because she was a princess and she was hot. Now they laugh at her. Same with Liza Minnelli, she was hot and sang well. Now it's enough with New York, New York. Why? Because she's not hot anymore. The same will happen with norah jones. She can do anything now because she's hot and sings well. When she'll just sing well, it won't be enough anymore. Same with everyone and everything. We think we admire something, whereas we're admiring something else. Like when they sell you a car, and they put a naked woman on the advertisement. You're buying the car and the naked woman... my ballsack is hurting again.

How does all this apply to me? To some degree, I just write, and this is interesting just because I write. There's nothing else but writing. But maybe when it won't be as new anymore, then I won't be as exciting and lose my 5 readers (yes, big rise in the number of readers lately). Or maybe my latent quality, the latent reason why people are reading is that I look promising, and when it will be evident that I don't deliver, then I will not be as interesting. Or maybe... who knows what else. Let's look for the simple superficial reason I usually hear: we like to hear about your progress. Well, guess what: maybe that

is the latent reason I was looking for. It is not about my excellent style of writing, it is not about my trading insights, it is about people feeling sorry for me... but then again this could only happen because I was a good writer, or at least because I wrote what I thought. So there's still merit in that. And why am I writing? We don't know, but there's many reasons, given that I've written non-stop since two years ago, and over 4000 posts in these two journals.

But maybe one of the reasons is that I want to force myself to become tired of singing "New York, New York" for years. By singing my same song of "I suck at formulas" and "I am a compulsive gambler", by singing twice as much as I'd sing it on my own, I am forcing myself to grow tired of it and learn another song.

In fact I did learn another few songs:

1) more systems created

2) have practiced with non-tampered systems trading for over a year

3) have started studying money management and portfolio selection in depth

The problem for me has always been that despite my efforts I learn slowly and this is because I think I already know everything. It's hard to learn if you think you know everything. But this habit becomes deeply ingrained by being around idiots throughout your life, but that happened because I've been, in a social sense, an underachiever, so I didn't go to harvard, but to a college where there was a large number of idiots, and there I chose a major chosen by a larger number of idiots... and so on. I am completely surrounded by idiots. My mom's an idiot. She got married for her looks. Relatives are pretty stupid, too. Few scientists. Most of them are humanities, and humanities are idiots.

And then the women. Which women did I look for? The good-looking ones. But I could not get them good-looking and intelligent, nope, because I am an underachiever. So they were dumb, borderline, and good-looking. So surrounded by stupid relatives, stupid women, stupid everyone... so i ended up feeling like i was very intelligent. Seriously, even at work, I am regarded as intelligent. Maybe also pretentious but definitely intelligent, but I am positive simply because they're all so stupid that there are no doubts they think I am intelligent.

But then comes trading, and math, and summation notation, and obviously there's this whole world appearing before my eyes, a world that had been hidden for years: the world of intelligent people, all those majoring in scientific subjects. And that is when I realize how ignorant and stupid I am. But still, I cannot speed up now. It doesn't help me read math manuals any faster. Anyway, time to try and sleep, once again. It happens every day. The ****ing job forces me to keep a 24 hours schedule, whereas I'd like to stay up 24 hours and sleep 12 hours, but hell no: the neighbour bitch and all that noise, and the work schedule... it's impossible. You're forced to have 24 hours sessions in this life, and they're all very similar. "The days can go on with regularity over and over, one day indistinguishable from the next. A long continuous chain".