Chris_Shaw

Active member

- Messages

- 121

- Likes

- 1

8/3/15 Morning Update 0600am PST.

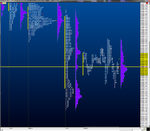

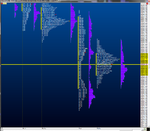

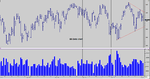

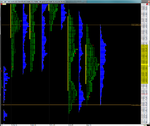

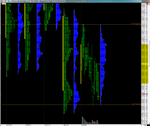

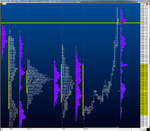

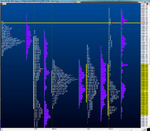

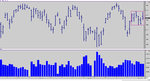

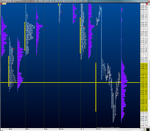

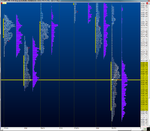

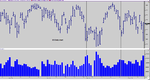

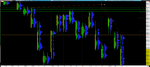

Volume is light; 148K. O/N inventory is net short but not 100%. O/N High is 2102.5 and O/N Low is 2092.75. Most of the activity has been inside Friday's range. I'm applying balance rules for my trade today. If the mkt breaks out of balance to the downside and finds acceptance, my targets will the poor lows discussed in Friday's recap. If the trades to upside out of balance and accelerates, the mkt could attempt to take the highs from 7/31 (2108.5), 7/23 (Poor at 2110.5), 7/22 (2112).

Volume is light; 148K. O/N inventory is net short but not 100%. O/N High is 2102.5 and O/N Low is 2092.75. Most of the activity has been inside Friday's range. I'm applying balance rules for my trade today. If the mkt breaks out of balance to the downside and finds acceptance, my targets will the poor lows discussed in Friday's recap. If the trades to upside out of balance and accelerates, the mkt could attempt to take the highs from 7/31 (2108.5), 7/23 (Poor at 2110.5), 7/22 (2112).