M

malaguti

Cheers mate. i guess theres a limit to how much time I can spend looking after hours..but I ill be calling Updata nonethelesshi malaguti

thanks for the chart

i am looking at that dax chart you posted and comparing it ...the hilo plot

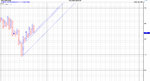

anyway here is the ftse hourly

2 trendlines to watch

the main has supp at 5850 area/green

the internal is 5900 area/light blue