Dentalfloss

Legendary member

- Messages

- 63,404

- Likes

- 3,726

hi malaguti

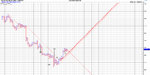

i got myeself some 10 minute data for barc

not an easy one

in fact it tricked chartcraft into going long

here is the chart

showing the downtrends

the first one was a short one and sudden

the second one is far more tradeable...the red line

you can see how many consecutive p/f signals there were on the second downtrend

so,we keep the red line as the trend identifier....any move to the line and we close any shorts.that shows.the trend is weakening

also,to make life more intolerable,there was a long period of consolidation between first move down and second move

i got myeself some 10 minute data for barc

not an easy one

in fact it tricked chartcraft into going long

here is the chart

showing the downtrends

the first one was a short one and sudden

the second one is far more tradeable...the red line

you can see how many consecutive p/f signals there were on the second downtrend

so,we keep the red line as the trend identifier....any move to the line and we close any shorts.that shows.the trend is weakening

also,to make life more intolerable,there was a long period of consolidation between first move down and second move

Last edited: