the 1m pattern which I missed allowed the possibility for the following trade:

This is using a 10k USD account size, with $50 at risk for the entry, 1 pip spread and 1 pip slippage. Exact entry method is using a A-D retracement and a Trailing One Bar Sell Stop, which elects the trader into the position with a 5 pip stop loss.

Now -

why would I have been looking to go short:

1) I already detailed that as my alternative scenario, a retrace back to the breakout TL from the 4hr pattern, so once the Support TL failed to hold, my Pattern+Price+Time setup failed, and the likely move was down

2) My daytrading trend system i've been talking about is based in 4 components:

- 15m Relative Strength currency meter giving trend conditions

- 5m Trend ID agreeing with RS

- Time Event

- Pattern for entry

I trail out, as i've said (which i need to adapt this to have more exit strategies, including % open profit lost stop out) - and i use the technical trailing exit for my exit as of now. I have an initial stop loss based on points beyond the pattern D point, which switches to the trailing exit as the trend goes.

-- Currency Strength

I use the Hawkeye Fatman Currency Meter - It is smooth, and i've found it to be reliable. Observe the EUR line at 700 closed down, with the USD line OB yet higher. I prefer to see the strengthening currency OS, however good trades can come from this configuration as well (both lines OB).

With EUR down, USD up, the trade had short side conditions from 700.

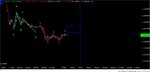

-- Trend

Again, a product - i use Hawkeye Trend+Stops. I'm not affiliated with Hawkeye, I just use these two tools of theirs. There may be better tools out there - i'm happy and can make money with these. So i use these.

The 5m Trend ID was bearish from 615 - so once the Fatman was bearish EURUSD, and the Trend was bearish, and I had my time condition - which i had a target at 550, and the reaction from the 500 releases was also bearish - I now was required per my rules to begin entering on bearish patterns.

Following the conditions, on the 5m you can see some whipsaw near 830. Strategy would be short and holding to the D-point pattern stop loss, per the rules, during this whipsaw. New entries would not be allowed, not until the RS and Trend conditions returned following the 910 target.

----

So, you can see i missed a 6:1 trade clear with my daytrading system. Why? Too damn tired, i had 3.5 hrs sleep, definitely need 6-8.. 7hrs & coffee, i'm good! Possibly too much speaker hugging in my youth, i don't know.. I need my sleep, i know that. I essentially gave up trading on Friday at precisely the moment i needed to be most focused. My long bias had failed, and even though i had an alternatively game plan, i was unable to carry it out. i passed out on a couch pillow.

The great news, is that all these rules are objective. They can be automated. So, in the future - who knows - maybe I'll be able to catch ones like this even when sleeping.