Thx. So this was just a quick exercise to demo some discretionary FX short-term trading. I've noticed that a lot of people like to say that this can't be done. It sounds cliched, but a lot of practice, focus & screen time are necessary. In brief, the article/book you mentioned on "flow" sums up the ideal state of mind for this approach (which was why I thought this might be relevant to the thread).

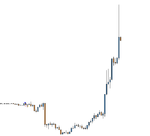

As a v brief description of the trades: what we saw in the early morning (the hour before my first sim trade) on EURUSD/6E was sellers lose control. As buyers started to move price up, & I saw confirmation of this in the PA & order-flow, I went long. This small buying wave then hit offers around 08:00 where I went short (but didn't run the trade, as buyers had not yet lost control). Price fell back further and re-tested buyers, who once again stepped in, allowing another long entry. Price then went into a consolidation.

This type of trading is maybe a little like professional sport. It's quite quick, maybe even simple, to describe the approach, but it's not easy. Just my 2c.

DJ

Great post.

By order flow what do you actual mean ? Are you viewing the market depth? If yes can you post a screenshot? Thank you, I am always open to new things. Did you read the book?