You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: US SP 500 Long Entry – Mar 11 Spread Update

Stopped out at breakeven

Not sure if my S&P position is going to survive this down move. Looks like it has some conviction.

Stopped out at breakeven

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Closed at 7125 for +42 pts (£84, 3.34pm) - close enough to 7120!

Good trading 👍

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: BG Group Entry - Jun 11 Spread

Price has hit my mental stop, however if price stays near these levels it will stlll be BG Groups highest weekly close, so that has more weight for me. So I'm going to continue to hold this for now.

BG group spiked up through the previous highs this morning and set off my alert. It's pulled back around 4% from the high and below the previous high again, so I've placed a speculative long position on Jun 11 Spread. But there's a chance today could be the top, so I've got a fairly tight stop loss.

Trade

BG Group Jun 11 Spread

Direction: Long

Entry Price: 1420.35

Spread: 12.31

Stop: 1379

Target: 1600

Account Risk: 0.5%

Potential Account Profit: 2.19%

Risk Ratio: 4.34

Price has hit my mental stop, however if price stays near these levels it will stlll be BG Groups highest weekly close, so that has more weight for me. So I'm going to continue to hold this for now.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: BG Group Entry - Jun 11 Spread

It didn't manage to make a new weekly closing high. I should have waited until the last half hour to consider entering this. A sh£tty day for me today.

Price has hit my mental stop, however if price stays near these levels it will stlll be BG Groups highest weekly close, so that has more weight for me. So I'm going to continue to hold this for now.

It didn't manage to make a new weekly closing high. I should have waited until the last half hour to consider entering this. A sh£tty day for me today.

Everyone has them isatrader. I used to (and still do) beat myself up about what I 'should have done'. This just caused me to become more frustrated and 'force' trades resulting in more failure/frustration etc.

I'm glad for weekends sometimes so I am forced to step back!

Have a good one.

I'm glad for weekends sometimes so I am forced to step back!

Have a good one.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Account Update

Not a good week for me this week, down 1.04%. I made a number of mistakes which I need to learn from.

1. I let advice from someone else affect a trading decision. I've got to learn to have conviction in my own analysis once I've placed a trade if I've set it up with correct money management, stop loss and exit target.

2. I broke my money management rules and let a trade go past my stop loss level.

3. I entered a trade on a weekly signal far too early. The signal was on at the beginning of the day Friday, but it wasn't by the end of the day. So a new rule for me is that when I'm using a weekly signal that I need to wait until the last 30 minutes of the trading day to make sure that the signal is valid.

Performance

My SB Account

Weekly: -1.04%

YTD: -2.25%

S&P 500

Weekly: -0.55%

YTD: +1.49%

FTSE 100

Weekly: -0.25%

YTD: -0.31%

January is almost over and it hasn't been a good start to the year for me as I'm back at break even for the account, but I keep learning more every trade and will try my best not to repeat the mistakes I've identified.

Have a good weekend.

Not a good week for me this week, down 1.04%. I made a number of mistakes which I need to learn from.

1. I let advice from someone else affect a trading decision. I've got to learn to have conviction in my own analysis once I've placed a trade if I've set it up with correct money management, stop loss and exit target.

2. I broke my money management rules and let a trade go past my stop loss level.

3. I entered a trade on a weekly signal far too early. The signal was on at the beginning of the day Friday, but it wasn't by the end of the day. So a new rule for me is that when I'm using a weekly signal that I need to wait until the last 30 minutes of the trading day to make sure that the signal is valid.

Performance

My SB Account

Weekly: -1.04%

YTD: -2.25%

S&P 500

Weekly: -0.55%

YTD: +1.49%

FTSE 100

Weekly: -0.25%

YTD: -0.31%

January is almost over and it hasn't been a good start to the year for me as I'm back at break even for the account, but I keep learning more every trade and will try my best not to repeat the mistakes I've identified.

Have a good weekend.

pingvin123

Junior member

- Messages

- 28

- Likes

- 1

Re: Account Update

That was one of my problems, too. That is partially why I chosed GBPJPY, becouse there is not much comments on this pair. If I would choose EURUSD I would spend lots of time reading other people's analysis, but would never make my own effort...

Cheer up, man, 👍 there are posibilities almost every day almost every where, you gona make it! Anyone with such analytical aproach will!!!

1. I let advice from someone else affect a trading decision. I've got to learn to have conviction in my own analysis once I've placed a trade if I've set it up with correct money management, stop loss and exit target.

That was one of my problems, too. That is partially why I chosed GBPJPY, becouse there is not much comments on this pair. If I would choose EURUSD I would spend lots of time reading other people's analysis, but would never make my own effort...

Cheer up, man, 👍 there are posibilities almost every day almost every where, you gona make it! Anyone with such analytical aproach will!!!

Re: Account Update

you're doing fairly well really, considering the way the FTSE has been trading so far this year. My SB account is down nearly 9% !

Not a good week for me this week, down 1.04%. I made a number of mistakes which I need to learn from.

1. I let advice from someone else affect a trading decision. I've got to learn to have conviction in my own analysis once I've placed a trade if I've set it up with correct money management, stop loss and exit target.

2. I broke my money management rules and let a trade go past my stop loss level.

3. I entered a trade on a weekly signal far too early. The signal was on at the beginning of the day Friday, but it wasn't by the end of the day. So a new rule for me is that when I'm using a weekly signal that I need to wait until the last 30 minutes of the trading day to make sure that the signal is valid.

Performance

My SB Account

Weekly: -1.04%

YTD: -2.25%

S&P 500

Weekly: -0.55%

YTD: +1.49%

FTSE 100

Weekly: -0.25%

YTD: -0.31%

January is almost over and it hasn't been a good start to the year for me as I'm back at break even for the account, but I keep learning more every trade and will try my best not to repeat the mistakes I've identified.

Have a good weekend.

you're doing fairly well really, considering the way the FTSE has been trading so far this year. My SB account is down nearly 9% !

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: Account Update

To be fair, I'm fairly strict with my risk management. It seems though like a lot of people don't seem to be as strict with their spread betting accounts as other accounts for some reason. Not sure why this is though?

you're doing fairly well really, considering the way the FTSE has been trading so far this year. My SB account is down nearly 9% !

To be fair, I'm fairly strict with my risk management. It seems though like a lot of people don't seem to be as strict with their spread betting accounts as other accounts for some reason. Not sure why this is though?

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: Fresnillo (FRES) – Entry

Stop moved to 1264

Trade

Fresnillo Rolling Spread

Direction: Long

Entry Price: 1284.29

Spread: 4.59

Stop: 1243

Target: 1400

Account Risk: 0.5%

Potential Account Profit: 1.41%

Risk Ratio: 2.8

Stop moved to 1264

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

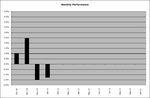

Monthly Account Update

Attached is the charts up to the end of January and my January trades spreadsheet. It wasn't a good month for me, but I recovered all of Fridays loses today with the addition of the Fresnillo trade.

I'm recovering a bit relative to the FTSE but the S&P is still outperforming my account. So the aim next month is to outperform the S&P 500 and to have a profitable month.

I'm also doing one trade a week in a trading game thread I've started (see http://www.trade2win.com/boards/swing-position-trading/116688-one-trade-week.html#post1404498) so I'm going to try and trade my picks each week in my SB account and maybe some of the other members picks if they look good and I have the risk available.

Anyway January is over, so the slate is clean and I'm going to work hard during February to try to get back to winning ways again.

Performance

My SB Account

YTD: -1.27%

S&P 500

YTD: +2.26%

FTSE 100

YTD: -0.63%

Attached is the charts up to the end of January and my January trades spreadsheet. It wasn't a good month for me, but I recovered all of Fridays loses today with the addition of the Fresnillo trade.

I'm recovering a bit relative to the FTSE but the S&P is still outperforming my account. So the aim next month is to outperform the S&P 500 and to have a profitable month.

I'm also doing one trade a week in a trading game thread I've started (see http://www.trade2win.com/boards/swing-position-trading/116688-one-trade-week.html#post1404498) so I'm going to try and trade my picks each week in my SB account and maybe some of the other members picks if they look good and I have the risk available.

Anyway January is over, so the slate is clean and I'm going to work hard during February to try to get back to winning ways again.

Performance

My SB Account

YTD: -1.27%

S&P 500

YTD: +2.26%

FTSE 100

YTD: -0.63%

Attachments

Last edited:

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Fresnillo (FRES) – Closed Position

Closing Trade

Entry Price: 1284.29

Exit Price: 1324.67

Percentage Gain: 3.14%

Account Percentage Gain: 0.50%

Daily Keltner Channel Captured: 6%

Trade Grade: C-

Trade

Fresnillo Rolling Spread

Direction: Long

Entry Price: 1284.29

Spread: 4.59

Stop: 1243

Target: 1400

Account Risk: 0.5%

Potential Account Profit: 1.41%

Risk Ratio: 2.8

Closing Trade

Entry Price: 1284.29

Exit Price: 1324.67

Percentage Gain: 3.14%

Account Percentage Gain: 0.50%

Daily Keltner Channel Captured: 6%

Trade Grade: C-

Similar threads

- Replies

- 1

- Views

- 2K