isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

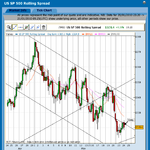

I took profits on my medium term Palladium short just before the close tonight as I'm concerned that EURUSD was hovering at the key 1.41 level after a strong move down to there this week. The moves have been sharp in both directions all week so my concern is the Dollar index could sell off a bit on the open on Sunday night and that would give commodities a bounce again and wipe out this weeks excellent profits. It looks possible to me as a number of commodities are at or near support levels so I booked my profits the Palladium and Gold shorts I had on with nice gains in both. Below is the closing trades and charts:

Closing Trade

Gold Rolling Spread

Direction: Short

Entry: 1504

Exit: 1492.7

Percentage Gain: 1.25%

ATR Adjusted Percentage Gain: 0.62%

Trade Grade: C

Closing Trade

Palladium June Spread

Direction: Short

Entry: 730.98

Exit: 711.20

Percentage Gain: 2.20%

ATR Adjusted Percentage Gain: 1.50%

Trade Grade: A-

The tally for the week was 5 trades. 4 wins and 1 loss and I added 5.41% to my account which was very pleasing after a few bad weeks previously. I'm still bearish on the metals so I'm going to be looking for a good entry point for further shorting.

Closing Trade

Gold Rolling Spread

Direction: Short

Entry: 1504

Exit: 1492.7

Percentage Gain: 1.25%

ATR Adjusted Percentage Gain: 0.62%

Trade Grade: C

Closing Trade

Palladium June Spread

Direction: Short

Entry: 730.98

Exit: 711.20

Percentage Gain: 2.20%

ATR Adjusted Percentage Gain: 1.50%

Trade Grade: A-

The tally for the week was 5 trades. 4 wins and 1 loss and I added 5.41% to my account which was very pleasing after a few bad weeks previously. I'm still bearish on the metals so I'm going to be looking for a good entry point for further shorting.