isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: Support and Resistance

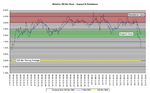

Price action is now approaching the 2% support area above the SMA. So a possible pause and rebound soon. It will be interesting to see if it can break through 2% level today as it will make me much more bearish.

Price is currently at 3.43% above the 200 bar SMA and so a short term top is likely soon maybe?

Price action is now approaching the 2% support area above the SMA. So a possible pause and rebound soon. It will be interesting to see if it can break through 2% level today as it will make me much more bearish.