isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

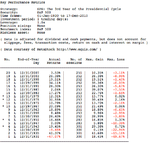

S&P 500 Trades – Jan 11 Week 2

Attached is my trades in the S&P 500 Index this week. Both closed positions were losers and the current open position is currently negative as well. I have given the stop loss more room as I think the market is getting a bit old after 7 up weeks. But the short term price action still looks positive, so I’m going to wait and see what Mondays price action looks like before moving the stop down or closing it.

Constructive critique of the trades would be appreciated.

Attached is my trades in the S&P 500 Index this week. Both closed positions were losers and the current open position is currently negative as well. I have given the stop loss more room as I think the market is getting a bit old after 7 up weeks. But the short term price action still looks positive, so I’m going to wait and see what Mondays price action looks like before moving the stop down or closing it.

Constructive critique of the trades would be appreciated.