NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

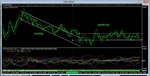

people ask me in my world what is trading vs gambling ?

well its this..the green line is the usd index based on my own indicator/calcs .........only trade usd pairs when you see a bias on the usd itself ........otherwise you are gambling......and losing !! :smart:

N

well its this..the green line is the usd index based on my own indicator/calcs .........only trade usd pairs when you see a bias on the usd itself ........otherwise you are gambling......and losing !! :smart:

N