Jon Salgerier

Junior member

- Messages

- 17

- Likes

- 4

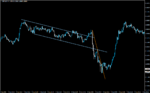

GU

1 min LR chart with KT's

approx 50 pip drop after 3 09 pm and then 50 pip move up after 3 30pm onwards

Good evening.

I was finally able to squeeze in a couple hours of trading again today and while I made it to breakeven I left a lot of pips on the table.

One very obvious spot was this one in GU at 3 50 PM where I missed the move entirely and I wonder if you could explain what you factored in to the buy decision at that point?

I have attached my graph from that time period and my general problem was that I was expecting a move downwards and therefore looked for signs in that direction.

I had support at 1.5560 and resistance at 1.5580. I also had a falling trendline over the price (yellow on the chart) going from 3:12pm to 3:38pm. I did feel that this trendline was pretty weak but it seemed to hold.

So let us jump back to 3:39pm. 🙂

At this point I take the following into account in no particular order:

1) The two faster LRs are above price (in fact 8 out of 9 are, and all are falling) and short term trend is bearish

2) We have a low at 3:30 pm (mentioned by you in the thread as a possible 30 minute rule event)

3) The price seems to have bounced on my falling trendline (yellow)

4) We are at the end of a TW and on a KT.

So I decide that this is a good spot to go for a Scalp sell with the idea that price will go for a new low below 1.5560 and I go short at 3:39pm at 1.5567 (which is the low of the candle) with a 5 pip stop at 1.5572ish.

Unfortunately I am stopped out at 3.44pm when the price touches 1.5572.

Of course what I should have been doing was to realize that the assumption was false and throw everything out the window and start on a new sheet open for the possibility that we would instead be going up, but while licking my wounds the price started moving north and I felt that I wouldn't want to catch the rising(?) knife and hence missed the entire lift.

So the question is.. Was I completely off my tits going short and in that case what did I miss? or was it the rare exception that any of you guys could have slumped into?

And while on the subject. What was the key trigger at 3:50? Was it the crossing of the LRs or did you have more factors present then?

Oh and by the way, I am on GMT+2 so time on chart is one hour off.

Many thanks in advance!

Best regards

Jon

Attachments

Last edited: