You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread How To Make Money Trading The Markets.

- Thread starter Mr. Charts

- Start date

- Watchers 310

nelsonhimes

Junior member

- Messages

- 21

- Likes

- 0

I love to read interesting post that has knowledge to impart! Thank you for sharing your insights! I will avidly wait for your next thread entry.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Sometimes you get days like yesterday when there are plenty of opportunities, other days there are fewer but if you keep to the methodology you tend to pick up some of those situations even on choppy days. It's like anything else, work and application make the difference.

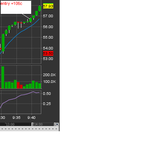

Today I ran a scan simply looking for biggest movers and picked up KLAC just 8 minutes after market open. I joined the move on rising candles after the brief consolidation.

Here is the move with the pointer at entry and image taken at exit for 106c per share.

When you think about it, it's really only:

strong trend - brief pause - enter only when/if the trend resumes, not before.

Look at the chart, what's not to like? 😆

Not rocket science.

Yes, the ATR was much higher but provided the move is clear you just adjust down your position size to keep your risk in case of failure at the dollar level you find acceptable.

My other results today (including losers !) are on my web site which you have to google to find 😎

Today I ran a scan simply looking for biggest movers and picked up KLAC just 8 minutes after market open. I joined the move on rising candles after the brief consolidation.

Here is the move with the pointer at entry and image taken at exit for 106c per share.

When you think about it, it's really only:

strong trend - brief pause - enter only when/if the trend resumes, not before.

Look at the chart, what's not to like? 😆

Not rocket science.

Yes, the ATR was much higher but provided the move is clear you just adjust down your position size to keep your risk in case of failure at the dollar level you find acceptable.

My other results today (including losers !) are on my web site which you have to google to find 😎

Attachments

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

Phd in hindsight -knowing when to take all those easy trades......

A T2W Billionaire.🙂

A T2W Billionaire.🙂

Based on his claims he should be but might guess is he isn't.

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

Based on his claims he should be but might guess is he isn't.

We won't delete your posts , just ban u!

M

malaguti

We won't delete your posts , just ban u!

so how much did you two actually lose then, using his methods/teaching?

Don't tell me..you haven't actually tried

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

so how much did you two actually lose then, using his methods/teaching?

Don't tell me..you haven't actually tried

Just working out which posters are working together to support traders and which ones are accomplices trying to help noobs.

so how much did you two actually lose then, using his methods/teaching?

Don't tell me..you haven't actually tried

And how much do you actually make trading his methods-there is still no individual on this forum who has verified that his trading technique is profitable

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

And how much do you actually make trading his methods-there is still no individual on this forum who has verified that his trading technique is profitable

Shut up before u get banned

I am an irregular member on this forum and have found comments of substance generally from experienced traders - diverse views maybe but useful. The thing I noticed though is the conversation tends to degenerate very quickly into some kind of pissing contest. So sad.

I am an irregular member on this forum and have found comments of substance generally from experienced traders - diverse views maybe but useful. The thing I noticed though is the conversation tends to degenerate very quickly into some kind of pissing contest. So sad.

unfortunately its the same on any forum

even the fishing forums and such like are the same (apparently)

who caught the biggest fish and old fish tales

very similar to trading sites

unfortunately its the same on any forum

even the fishing forums and such like are the same (apparently)

who caught the biggest fish and old fish tales

very similar to trading sites

The issue is not who can catch a bigger fish. If that is the focus of the discussions and even if there are oppposing views, at least we can learn something useful from it. It is just the conversation tends to degenerate into the one liners that are either facetious or cynical that doesn't add anything of value to the conversation.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Thank you to the people who have made positive posts.

As I've said many times before all stocks are alerted on my private members site BEFORE I take the trade.

Every single time.

No, that is NOT an invitation to join !

Anyway, today was choppy again but did produce opportunities, including some using this particular method.

I found RIMM by simply running a scan for biggest %age losers and gainers. I was fortunate with RIMM as I happened to run the scan as it waterfalled. If I'd run it a few minutes later I'd have missed it, but if you keep on trying and working hard then you sometimes create your own good fortune.

This was 115c per share.

Not a trade for beginners however !

As I've said many times before all stocks are alerted on my private members site BEFORE I take the trade.

Every single time.

No, that is NOT an invitation to join !

Anyway, today was choppy again but did produce opportunities, including some using this particular method.

I found RIMM by simply running a scan for biggest %age losers and gainers. I was fortunate with RIMM as I happened to run the scan as it waterfalled. If I'd run it a few minutes later I'd have missed it, but if you keep on trying and working hard then you sometimes create your own good fortune.

This was 115c per share.

Not a trade for beginners however !

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

KERX was quite different.

I always read through the news stories before market open and this one looked as if it might present an opportunity so it went on my alert list as one to watch.

A bit of simple common sense news reading sometimes produces a good trade. People like to parrot "the news is in the price". Well, sometimes that is true, but often not. In any case this style of trading is based on price action reflecting sentiment and buying/selling pressures in the real world, not in a world of guesswork and expectation.

After a steep rise it pulled back a little then headed North again so I went long as soon as it broke to a new high on rising 3 min candles producing a steadily but gently moving gain of 57c per share.

Again with this stock (unlike RIMM which had a large element of fortunate timing) method, method,method and what's not to like about the chart.

Tight stop as described many times earlier in this thread to provide safety and a minimum loss if the trade doesn't succeed.

I always read through the news stories before market open and this one looked as if it might present an opportunity so it went on my alert list as one to watch.

A bit of simple common sense news reading sometimes produces a good trade. People like to parrot "the news is in the price". Well, sometimes that is true, but often not. In any case this style of trading is based on price action reflecting sentiment and buying/selling pressures in the real world, not in a world of guesswork and expectation.

After a steep rise it pulled back a little then headed North again so I went long as soon as it broke to a new high on rising 3 min candles producing a steadily but gently moving gain of 57c per share.

Again with this stock (unlike RIMM which had a large element of fortunate timing) method, method,method and what's not to like about the chart.

Tight stop as described many times earlier in this thread to provide safety and a minimum loss if the trade doesn't succeed.

Attachments

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Forgot the RIMM chart

And oh yes, I had a couple of losing trades today like every other trader does, but they were small losers....cut the weeds and let the flowers grow.

Didn't know that RIMM trades in the $ 30s !

Attachments

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

As I've said many times before all stocks are alerted on my private members site BEFORE I take the trade.

.

Didn't know you give trading signals , as i understand it is just a watchlist but you don't give entries and exits .... here is a suggestion why not publish your system at Collective2 .

Similar threads

- Locked

- Replies

- 2

- Views

- 4K