The particular method in this thread is not difficult.

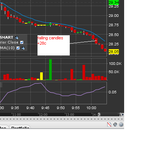

For example look at HSH.

I ran a scan for biggest movers half an hour after open and scrolled through them looking for a really strong trend and saw HSH. It was selling off so I shorted it for a bread and butter type of trade of +28c per share.(Just BEFORE I shorted it I alerted the stock to people on my private members site as I always do - and no, do NOT contact me to ask if you can subscribe because the answer is no.)

The method of finding the stock is simple, run a scan. Of course if I'd run the same scan a few minutes earlier I'd have been in earlier and made more money. Time of entry with this type of trade depends on when I find it. Obviously big movers often produce trends and it's those strong trends I'm looking for, not weak ones. How do you spot the difference? Well there are plenty of examples on this thread but here is one from today. Look how strong the trend is. Remember not all will be profitable but with a tight stop loss and then trailing stop as I've described earlier, and a lower ATR stock, you will keep any losers small.

As I've said before, don't believe me when I say it works or anybody else who says it doesn't, paper test it for yourself at least a hundred times so your results are statistically significant, then maybe try it out live with a small position size.

Entry at point of arrow, exit at time of screenshot.

Happy New Year,

Richard