In the distant past I have used different channels and of course trendlines.

Schiff Pitchfork in particular is of interest to me, as it relates to wave / market structure.

You will notice that I draw Fibs including RET and EXT at both ends, that is for convenience.

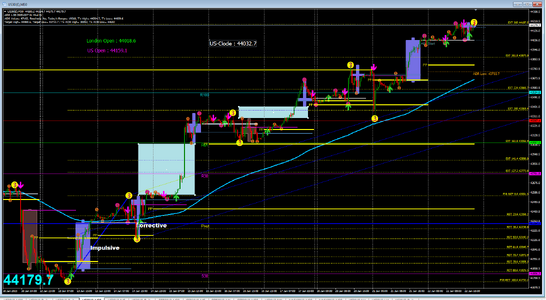

For example, long time ago with other trader we spend some time looking at the first impulsive to Which Fibs have been applied, our finding was that Dax like to terminate the move at 224, and DOW at 261 to 300 during the session or there about, like today

missed the last 70 points as I left trading desk to see my granddaughter - Pap duties

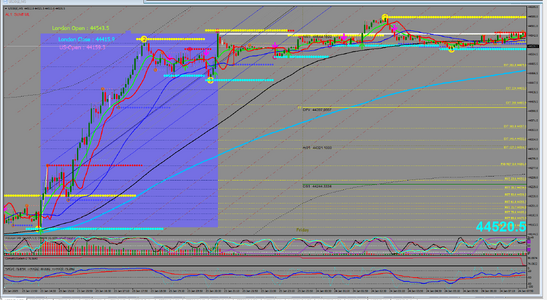

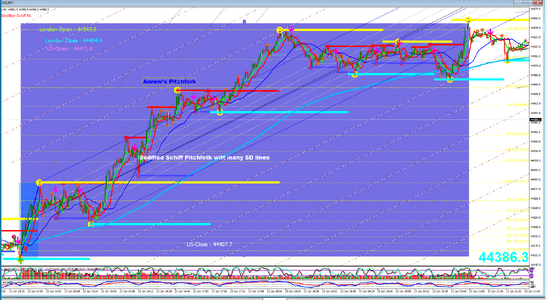

First chart MT4 with the US session candle bar M5 - top of the Fib channel also have been reached, coincided with SD3 of the pitchfork, beauty

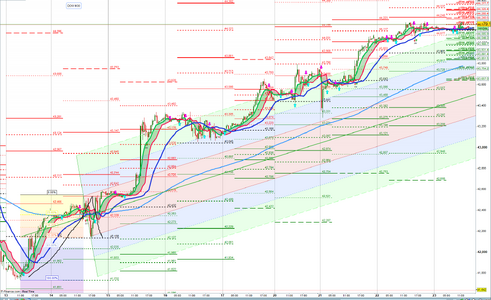

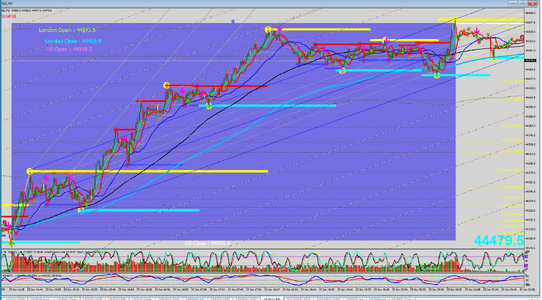

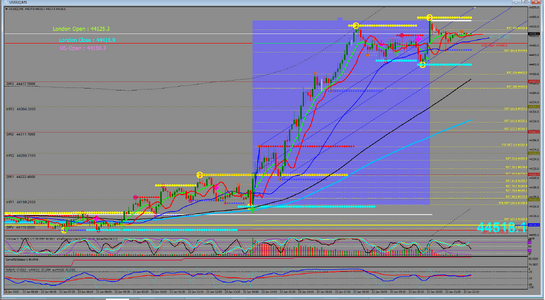

Second chart PTR M5

The arrows are created by ASCtrend, they very much coincide with the crossing of the Smoothed MA5 closed with the Smoothed MA5 closed shifted 5

It is my lazy approach, so I do not want to miss that cross, MA5 also links to the stochs set to 5,3,3, that is a miner thing on a shorter TF but I use that same setup on TFs I use, when stochs play a more important role like on Daily - H4 - M30 in my trading strategy, along side of many other things of course of which PA and market structure are the most important, just sensible.

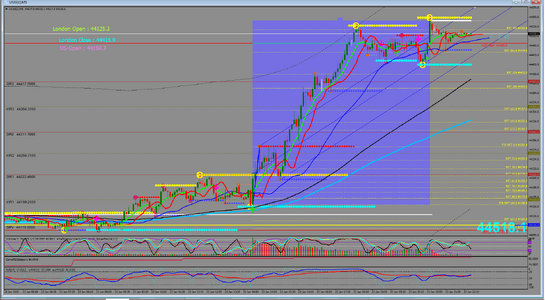

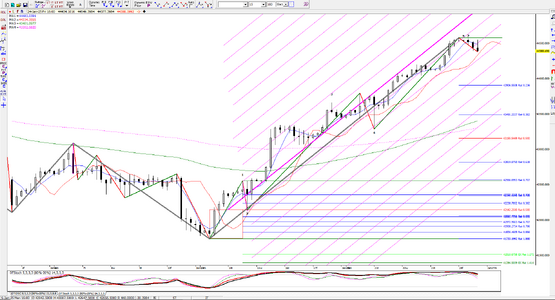

The third chart is Schiff fork using the MT4 indicator, looks good and the manually drawn ones look ok too, esp on the PTR where the additional SDs can be added.

Mr President did not disappoint yesterday, thought snow was melting in Davos, and the boss of Bank Of America needed instant medical attention and immanent change of pamper.

In the first law, an object will not change its motion unless a force acts on it. In the second law, the force on an object is equal to its mass times its acceleration. In the third law, when two objects interact, they apply forces to each other of equal magnitude and opposite direction.

( unless we find Market Makers - and learn how to take advantage of their "facilitating activities") my sarcasm, but serious matter anyway.

It is likely that Newton would agree that MM have a "special place" when his laws are applied to trading - but that is another matter.

It can be and must be said that Newtons laws are very much foundational including the momentum applied in trading.

Since Newton there have been further theories and interpretation of Albert Einstein and others, so we learn that light doesn't travel in straight way and that photons possess some kind of mas. For the purpose of this post lets limit it to Newtons Laws.

At times the most important things have been allotted the less number of attention and words.

The language of motion, momentum and energy of all kind, including emotional energy is often used in describing market condition and PA.

That is the language of fractals, order, chaos and entropy, Market Structure, HH/HL and LL/LH, Impulsive and corrective wave, ABC and 123 structure and many many others.

Once there is understanding of these basic Newtonian laws,

one needs wisdom how to successfully apply that knowledge.

This wisdom has to saturate our cognitive processes and activities, trading included.

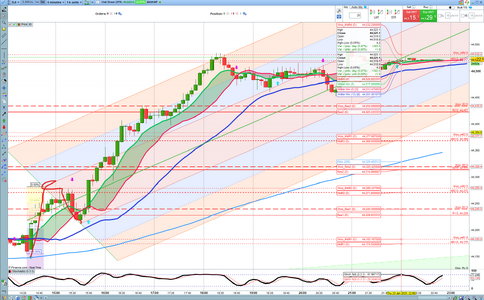

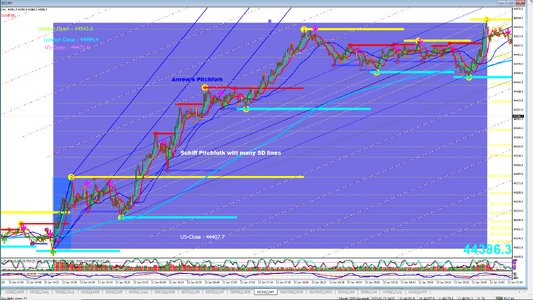

I think that Andrew's Pitchfork and Schiff Pitchforks relate and coexist well with Market Structure, which is incredibly important concept of TA.

By Market Structure I mean all types of "grid" that can be imposed as background on the PA flow, things like HH/HL and reverse, fractals leading to Zigzags, all type of waves, ABC, 12345/123, abs-abcx, Elliot and Harmonic waves, what is important to me is the ability to determine an impulsive and corrective PA move, one can call it wave, supplemented by geometry and Fibonacci (on price and time) and if possible cycles.

I am convinced that Pitchforks are more useful than Standard Deviation Channel or Fibo Channel, it is due to Pitchfork construction, as FX4Newbis pointed out in the first post, so many years ago.

It is constructed using 3 alternating pivots: high-low-high or low-high-low. The center or Median Line (ML) is where the price tends to be drawn to about 80% of the time. The outer lines are where price is generally expected to lose steam.

Different charting software allows for different ways to draw these pitchforks and choose the particular one with the ML line reacting with the PA in the best way for a given purpose one uses the Pitchforks.

Below is an attempt to describe my current take on the subject of pitchforks. It is very limited and most likely not precise enough and at worst containing some cardinal mistakes. I will not be offended, indeed I would be grateful for any comment/s making me to further my understanding of the subject, resulting in more profitable trading.

I am aware that there are at least three types of Pitchforks, Andrew's Pitchfork (the original concept) and two subsequent variations, Schiff Pitchfork and Modified Schiff Pitchfork.

Andrew's Pitchfork

Thanksgiving turkey is usually stubbed several times from different sides with the pitchfork allowing for carving nice slices. When trading is concern, drawing pitchfork when the PA form a fractal pattern of H-L-H or L-H-L comes automatically, and a duration of a prevailing trend might not be such important consideration, so SD 1 usually is enough, as the PA is likely to rotate faster, profits are taken and one waits for another opportunity to come about. This is certainly a very profitable way to trade using Pitchforks, more likely standard Andrew's Pitchfork, as they seam to be less concerned with a longer lasting trends, and seam to be ideal for managing rotation in PA.

Schiff Pitchfork

Schiff Pitchfork - I think that the good place to draw that pitchfork variation is when the first impulsive is identified followed by completed corrective, the expectation is that the first impulsive will be followed by third impulsive, forth corrective and fifth impulsive ( or failed fifth).

If using MT4, I would draw Fibs on that (possible) first impulsive after the second corrective looks like being completed. The Fibs I draw include Retracements and Extensions, (both ways Extensions to make it easier for me - being lazy)

The ML line of Schiff Pitchfork is drawn from the Fib 50% Ret of that impulsive, from where the 50% Ret meets the left side of the box drawn over the whole of that impulsive(charts and link to the video will follow), so basically it is Andrew's Pitchfork when the ML line is drawn from different initial spot.

I addition to the above Schiff Pitchfork often has more Standard Deviation lines in order to contain PA/Trend for a longer time. Of course there nothing wrong in adding when possible more SD lines to the Andrews Pitchfork, one will see that Andrew's Pitchfork has got much steeper angle, and is likely to create another Andrew's Pitchfork, much faster that the Schiff Pitchfork

Modified Schiff Pitchfork

It is similar to Schiff Pitchfork, which is Andrew' Pitchfork drown from different spot.

Modified Schiff Pitchfork is Andrew's Pitchfork drawn from the Fib 50% Ret of that first impulsive impulsive, but the ML is drawn from the middle of the box, thus slightly changing the slope of the drawn ML, and all the SD lines related to that ML.

It is all about the slope of the controlling ML, rendering different Pitchforks more suitable for given application/s in respect of the all important PA and created by it Market Structure.

With multiple pitchforks the ML and SD lines will create a grid of diamonds like shapes, that subject demands much longer explanation - just to mention.

It is rather a long post, I have tried to be more precise, very likely have repeated the obvious. if that is the case please forgive me to have taken your precious time.

In any case I wish all happy stubbing irrespective of whichever Pitchfork one is choosing to use, Trident of Poseidon, or many throng other Pitchforks.

Good trades to all!!!