Joules MM1

Established member

- Messages

- 648

- Likes

- 142

another anecdotal "eek" chart

Fed and Bank of Japan caused gold crash

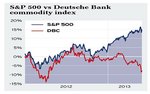

Commodity prices have been falling since September,

culminating in a rout over the past two weeks.

That is a classic warning for the global economy.

By Ambrose Evans-Pritchard

7:22PM BST 17 Apr 2013

link: Fed and Bank of Japan caused gold crash - Telegraph

Fed and Bank of Japan caused gold crash

Commodity prices have been falling since September,

culminating in a rout over the past two weeks.

That is a classic warning for the global economy.

By Ambrose Evans-Pritchard

7:22PM BST 17 Apr 2013

link: Fed and Bank of Japan caused gold crash - Telegraph