Atilla

Legendary member

- Messages

- 21,036

- Likes

- 4,207

i've watched a fair few of the vids now [kid in sweet shop]. the power of currency correlation stands out. i knew cable and swissy were opposites but i hadn't clicked you might be able to use a movement in one to predict a movement in the other.

curiously the thing they say comes closest to the 'holy grail' is the cot report but didn't mention further.

tiny cable range today so presumably breakout but which direction?

Morning all,

Very important day for cable imo with the big CPI stats coming out in the US. Should tell the bond markets where to go. When the markets are tight like this they are looking at news to feed off.

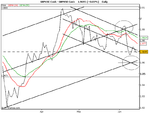

In these two StdErr Channels you can really clearly see where support kicks in and where resistance takes over. I love these SECs... 🙂

Here is my chart that I have been following and at the beginning of June I was considering a breakout to the down trend on the Std Err Channel. In fact I thought $2+ was here.

I didn't think we would fall below 1.97 but we did. However, I do think 1.96 will be a very strong support because it coincides with the long term SE channel support line as well as the short term one. Hence I still hold the view 1.96+ levels will hold and that a move up is in the wings.

Given all the heightened interest in bond activity & inflationary expectations in the US £ is still at 1.97. That to me speaks of strength in the £.

Finally, I still don't see the Fed raising rates. In March Bernanke made his famous speech about balancing inflation with growth. That was fundamental imo. Don't believe the Fed is worried about inflation as they should be.

In a nut shell with the elections round the corner they are far more worried about growth and perception and that should tell you where interest rates are going coupled with housing weakness.

So my bet is £ may wobble to 1.96 but ultimately it's going to make a decisive move up as soon as bond markets come to terms with their yields.

For now it might be best to hold off. I'll be out of FX and be playing with the indeces again.

Good trading everyone. 😀