P

postman

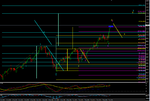

so you value fibs do you? i never trusted them myself but im happy to have my mind changed

no not as such.... just for support tool...

if they coincide with other factor then they have more significance....

So if they agree with what you think will happen use them, otherwise ignore them.

I think thats called 'Confirmation bias'.

Its akin to leaving out countries that dont match your thesis expectations and then saying Austerity is a good idea!

http://en.wikipedia.org/wiki/Growth_in_a_Time_of_Debt