is this what you're referring to re: poss hike??....didn't chase him though, let him run (got me corn earlier!), he'll be easier to mount now he's tired himself out a little......

😀 ....as far as where we go??!!....as always the 'news' events will play their part rest of this week, I don't try to pick direction, merely swim with the tide.....things could most certainly get worse before the northerly heights are seen again.

[20:36 GMT February 25] GBP/USD was dragged lower by EUR/USD today as the market

was caught off guard by an article on Market News (that looks suspiciously like

an ECB plant) that the ECB intends to discuss a rate cut as soon as the March 4

meeting, an eventuality the market had virtually ignored, given recent

pronouncements for board members. The market quickly reprised EUR/USD, taking

cable down as well, but EUR/GBP selling was able to limit the damage for a time.

A bounce from 0.6655 lows in EUR/GBP put Cable on the skids along with EUR/USD,

with the pound modestly overshooting the 50% retracement of this week's

1.8460/1.8945 rally at 1.8705 by 5 pips or so, before steadying. EUR/GBP rallies

should be rather mild given the divergent rate outlooks from the respective

central banks. Upwardly revised UK GDP today (+2.8% in Q4) should keep the MPC

on alert for higher rates to come later in the spring. All in all, cable still

looks like a good bet against the crosses like GBP/JPY, but a potential sea-

change in favor of the dollar may prove a more compelling story in the weeks

ahead.

[email protected]/rd

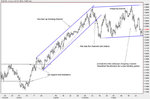

NB mentioned yesterday the 'noise' around this level, a Fib is evident here (8717)....watch the reaction point around this level....the overnight trendline is smacking on 8750 & we're still weak below here......as ever "trade what you see" & look at your charts for the obvious channel breaks, paying particular att'n to the TREND!