You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Elliott Wave Analysis

- Thread starter Trader Skillset

- Start date

- Watchers 11

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

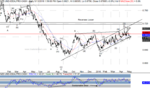

EURUSD Wave Count

The Wolf was fortunate enough to spend a few days last week at the headquarters of Goldman, Sachs. I say fortunate because it's always nice to interact with smart, thoughtful people, even if you happen to disagree about the outcomes with the vast majority of these rocket scientists.

Essentially the firm opinion is that a US recession is highly unlikely to happen within the next 12 months, and that conditions are favorable for risk assets. To support this thesis, Goldman trotted out everything from discounted cash flow models to variations of the "Fed model," which is essentially the opinion that low interest rates allow for high current valuations.

It's a bit intimidating to taking the other side of this bet considering the brain power on the other side. However, The Wolf has come away from these interactions more confident of the ultimate outcome, if not the exact timing, of the next major recession (depression?) and bear market will begin in risk assets. Here's the reason:

Every model Goldman (and every other bull) presents is ultimately informed by history; and, as such, it has an underlying assumption. That assumption is, "the future will look like the past;" or, another way of saying it is that the bulls use "equilibrium models." In an equilibrium model one assumes that a lower Fed Funds rate will lead to higher economic growth, and higher stock prices. In a sense this is true because a stream of cash flows is valued higher at a 2% discount rate compared to a 5% one. But, what if conditions are so bad that 0% rates (or negative rates) are implemented?

Japan is the poster child for the failure of equilibrium models. 0% rates didn't work there, because, at some unknown point, it crossed over from a country of equilibrium to disequilibrium. The crossover point isn't known exactly, but essentially it is the point where debt service crowds out and consumes capital rather than grows it.

The Elliott wave model is a disequilibrium model. It says, once a trend is fully formed (five waves up), it will correct. The larger the trend, the larger the correction. The larger the trend lasts, the closer you are to the ultimate correction. Equilibrium models tend to extrapolate the past, and since the US has had a great past, they assume the future will be equally as bright. But, inherent in the US today is a "survivor bias." In the past 50 years a number of one-time events occurred, which are unlikely to exist in the next 50 (WWII destroying economic capacity in Europe, debt buildup to 110% of GDP, USD hegemony, etc.).

The point is, if one assumes an optimistic future, one should use equilibrium models. But, equilibrium models (like the Fed model) fail miserably once a country crosses over to a disequilibrium world. The Wolf would argue that almost eight years of 0% is evidence that this threshold has been crossed, to the utter astonishment, and ridicule, of anyone still living in an equilibrium assumed world (Goldman, Bernanke, Obama, the establishment, etc.).

OK, rant over, now onto the Elliott wave charts.

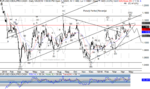

EURUSD

Prices reversed Monday from the internal trendline and followed through to the downside. We only have three waves down so far, and we did register a small Sustainable Bull reading on RSI, so the bears aren't in complete control, but we're bearish against 1.1530 looking for five down and a trendline break.

The Wolf was fortunate enough to spend a few days last week at the headquarters of Goldman, Sachs. I say fortunate because it's always nice to interact with smart, thoughtful people, even if you happen to disagree about the outcomes with the vast majority of these rocket scientists.

Essentially the firm opinion is that a US recession is highly unlikely to happen within the next 12 months, and that conditions are favorable for risk assets. To support this thesis, Goldman trotted out everything from discounted cash flow models to variations of the "Fed model," which is essentially the opinion that low interest rates allow for high current valuations.

It's a bit intimidating to taking the other side of this bet considering the brain power on the other side. However, The Wolf has come away from these interactions more confident of the ultimate outcome, if not the exact timing, of the next major recession (depression?) and bear market will begin in risk assets. Here's the reason:

Every model Goldman (and every other bull) presents is ultimately informed by history; and, as such, it has an underlying assumption. That assumption is, "the future will look like the past;" or, another way of saying it is that the bulls use "equilibrium models." In an equilibrium model one assumes that a lower Fed Funds rate will lead to higher economic growth, and higher stock prices. In a sense this is true because a stream of cash flows is valued higher at a 2% discount rate compared to a 5% one. But, what if conditions are so bad that 0% rates (or negative rates) are implemented?

Japan is the poster child for the failure of equilibrium models. 0% rates didn't work there, because, at some unknown point, it crossed over from a country of equilibrium to disequilibrium. The crossover point isn't known exactly, but essentially it is the point where debt service crowds out and consumes capital rather than grows it.

The Elliott wave model is a disequilibrium model. It says, once a trend is fully formed (five waves up), it will correct. The larger the trend, the larger the correction. The larger the trend lasts, the closer you are to the ultimate correction. Equilibrium models tend to extrapolate the past, and since the US has had a great past, they assume the future will be equally as bright. But, inherent in the US today is a "survivor bias." In the past 50 years a number of one-time events occurred, which are unlikely to exist in the next 50 (WWII destroying economic capacity in Europe, debt buildup to 110% of GDP, USD hegemony, etc.).

The point is, if one assumes an optimistic future, one should use equilibrium models. But, equilibrium models (like the Fed model) fail miserably once a country crosses over to a disequilibrium world. The Wolf would argue that almost eight years of 0% is evidence that this threshold has been crossed, to the utter astonishment, and ridicule, of anyone still living in an equilibrium assumed world (Goldman, Bernanke, Obama, the establishment, etc.).

OK, rant over, now onto the Elliott wave charts.

EURUSD

Prices reversed Monday from the internal trendline and followed through to the downside. We only have three waves down so far, and we did register a small Sustainable Bull reading on RSI, so the bears aren't in complete control, but we're bearish against 1.1530 looking for five down and a trendline break.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

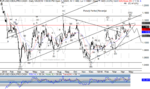

GBPUSD Wave Count

Here too, there was a significant reversal last week, from resistance. We are bearish here too, especially considering that on a weekly bar chart we had a bearish engulfing candle and a key reversal (a new high for the week, with a lower close). We're looking for a wash-out new low here, and in EURUSD on the back of "bad news out of Europe," although we suppose it could be on USD positive news (Fed rate hike?). Frankly, it doesn't matter, we're bearish, and that'll only change on a push past last week's high, although prices should remain well below that.

Here too, there was a significant reversal last week, from resistance. We are bearish here too, especially considering that on a weekly bar chart we had a bearish engulfing candle and a key reversal (a new high for the week, with a lower close). We're looking for a wash-out new low here, and in EURUSD on the back of "bad news out of Europe," although we suppose it could be on USD positive news (Fed rate hike?). Frankly, it doesn't matter, we're bearish, and that'll only change on a push past last week's high, although prices should remain well below that.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

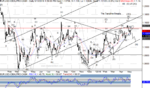

AUDUSD Wave Count

Indeed the tide has turned per our bearish assumption. Last week's spike and reversal leaves us looking much lower. We can drop our critical resistance to the .7691 level, but there's little reason for prices to push above the sharp down trendline. In fact, any touch of the line would have us looking to get even more aggressively bearish. Use any bounce to join the down trend. Prices should find some support near the previous peaks around .7400, but the RSI profile continues to point lower.

Indeed the tide has turned per our bearish assumption. Last week's spike and reversal leaves us looking much lower. We can drop our critical resistance to the .7691 level, but there's little reason for prices to push above the sharp down trendline. In fact, any touch of the line would have us looking to get even more aggressively bearish. Use any bounce to join the down trend. Prices should find some support near the previous peaks around .7400, but the RSI profile continues to point lower.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

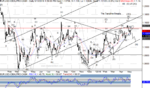

USDCAD Wave Count

The grinding into a low is complete, and the wave B bounce is now underway. The plethora of Sustainable Bear readings (lower grey RSI zone) suggest that the bounce is corrective though. We're likely looking at a zigzag up towards the 1.3000 area. Notice that prices are now back above the red "Huge Support" area. Better late than never, I guess.

The grinding into a low is complete, and the wave B bounce is now underway. The plethora of Sustainable Bear readings (lower grey RSI zone) suggest that the bounce is corrective though. We're likely looking at a zigzag up towards the 1.3000 area. Notice that prices are now back above the red "Huge Support" area. Better late than never, I guess.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

USDJPY Wave Count

Prices traced out the pattern we thought: one more new low followed by a reversal. We think the larger downtrend is complete, but it's too early to be certain. A period of backing and filling, and even a marginal new low isn't out of the question. We're going to need to see five up, a break of the red down trendline and then a corrective decline prior to getting ready for 150.00. Part of that reason is that USDJPY has been highly correlated with risk assets. In order to see 150.00 on USDJPY, we either need a break-down of that correlation or we need to prepare for an orgy of action to the upside in risk assets. What we'd like to see is strength in USDJPY start to correlate with USDTRY (and other EM pairs) rather than with the S&P 500.

Happy Trading!

The Wolf

Prices traced out the pattern we thought: one more new low followed by a reversal. We think the larger downtrend is complete, but it's too early to be certain. A period of backing and filling, and even a marginal new low isn't out of the question. We're going to need to see five up, a break of the red down trendline and then a corrective decline prior to getting ready for 150.00. Part of that reason is that USDJPY has been highly correlated with risk assets. In order to see 150.00 on USDJPY, we either need a break-down of that correlation or we need to prepare for an orgy of action to the upside in risk assets. What we'd like to see is strength in USDJPY start to correlate with USDTRY (and other EM pairs) rather than with the S&P 500.

Happy Trading!

The Wolf

Tq ignat....i like your video very much and nice wave marking

Thank you 🙂There's my new elliott wave video 🙂

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

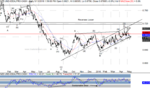

EURUSD Wave Count

Friday's break left a three wave rally in place, which we've labelled wave (ii). We may get an early week rally attempt, but we think the euro has turned lower. That's not to say it's going to be a straight shot lower, in fact, after reaching parity, it seems likely that EURUSD will be back at current levels late this year, according to our top count. In other words, this next decline towards parity should complete the larger degree decline and lead to a return towards the 1.2000 level.

Nearer term, RSI has dropped below 50, and while we will likely see some support from the up trendline around 1.1200, any support should be temporary. We're bearish against the wave (ii) high, although prices should likely remain well below that level.

Friday's break left a three wave rally in place, which we've labelled wave (ii). We may get an early week rally attempt, but we think the euro has turned lower. That's not to say it's going to be a straight shot lower, in fact, after reaching parity, it seems likely that EURUSD will be back at current levels late this year, according to our top count. In other words, this next decline towards parity should complete the larger degree decline and lead to a return towards the 1.2000 level.

Nearer term, RSI has dropped below 50, and while we will likely see some support from the up trendline around 1.1200, any support should be temporary. We're bearish against the wave (ii) high, although prices should likely remain well below that level.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

GBPUSD Wave Count

Would Brexit be GBP bullish since it would sever the link with the debt troubled Club Med countries (Spain, Italy, Greece, Portugal), or would it be GBP bearish since it would leave the BOE more free to print pounds? Any analysis you read on Brexit won't be able to answer this question, because we simply don't know. So, while Elliott wave analysis isn't perfect, it does give us objective criterion to prove or disprove our thesis.

Currently, our thesis is that GBPUSD is going lower, towards 1.33-1.30, and potentially lower. We can now lower our critical resistance to the wave (ii) high, similar to EURUSD. A push above that means something more complex to the upside is taking place for wave (4), or something more bullish, perhaps. But, until then, we see the rally off the low as a three wave move that's complete. We have five down for (i) and a three wave correction for (ii). Look for support to prove temporary.

Would Brexit be GBP bullish since it would sever the link with the debt troubled Club Med countries (Spain, Italy, Greece, Portugal), or would it be GBP bearish since it would leave the BOE more free to print pounds? Any analysis you read on Brexit won't be able to answer this question, because we simply don't know. So, while Elliott wave analysis isn't perfect, it does give us objective criterion to prove or disprove our thesis.

Currently, our thesis is that GBPUSD is going lower, towards 1.33-1.30, and potentially lower. We can now lower our critical resistance to the wave (ii) high, similar to EURUSD. A push above that means something more complex to the upside is taking place for wave (4), or something more bullish, perhaps. But, until then, we see the rally off the low as a three wave move that's complete. We have five down for (i) and a three wave correction for (ii). Look for support to prove temporary.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

AUDUSD Wave Count

We've been aggressively bearish AUDUSD, and we see no reason to change that view. Certainly, a wave 2 bounce is going to happen, but only after five down are complete for 1. We could force a nearly completed count for 1, which allows for a bounce back towards the .7600 area, however, it seems more likely that we'll see lower first, given the downside momentum. That means a bounce for wave 2 could be contained by the down trendline and the .7400 pivot area. The failure to hold that level last week, after a corrective bounce, leaves the bears in control.

We've been aggressively bearish AUDUSD, and we see no reason to change that view. Certainly, a wave 2 bounce is going to happen, but only after five down are complete for 1. We could force a nearly completed count for 1, which allows for a bounce back towards the .7600 area, however, it seems more likely that we'll see lower first, given the downside momentum. That means a bounce for wave 2 could be contained by the down trendline and the .7400 pivot area. The failure to hold that level last week, after a corrective bounce, leaves the bears in control.

Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

NZDUSD Wave Count

NZDUSD closed the week below the up trendline. Without a Sustainable Bull reading (upper blue zone) within the wave C of (X) rally, there's little reason to consider the current decline a correction. In fact, even if the larger trend had turned up, the choppy diagonal up from the wave B low would still mean a return to .6400 first. A rally back above the wave (ii) high would change things though, and that remains our critical resistance.

NZDUSD closed the week below the up trendline. Without a Sustainable Bull reading (upper blue zone) within the wave C of (X) rally, there's little reason to consider the current decline a correction. In fact, even if the larger trend had turned up, the choppy diagonal up from the wave B low would still mean a return to .6400 first. A rally back above the wave (ii) high would change things though, and that remains our critical resistance.

Similar threads

- Replies

- 2

- Views

- 9K