Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

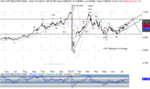

USDCHF Daily Wave Count

Rather than commenting on the rather untradeable USDCHF, I'll pose the dilemma below instead.

Coming into 2015, we were berating the Swiss National Bank (SNB) for its idiotic euro peg. We thought it would continue with the peg since the SNB actually wanted a weaker franc. As a result, it electronically printed francs to buy euros, which were falling in value. Then in January the SNB changed its tack. Instead of buying a falling euro, it chose to buy stocks instead. Now, given 21 years in various facets of the investment world, I consider myself a savvy veteran of this world. But, I can't for the life of me figure out why any citizen of Switzerland, or any other country, would want its central bank to buy stocks.

If the SNB wants a weaker franc, should it be buying assets that go up in value or down in value? And, wouldn't it make sense to leave the stock buying game to professionals in that area? Do you really want Janet Yellen in charge of a mutual fund, or ensuring that banks have adequate capital reserves. It's just another example of why countries should restrain government (and quasi government) officials - otherwise, there will inevitably be mission creep.

Happy Trading!

The Wolf

Rather than commenting on the rather untradeable USDCHF, I'll pose the dilemma below instead.

Coming into 2015, we were berating the Swiss National Bank (SNB) for its idiotic euro peg. We thought it would continue with the peg since the SNB actually wanted a weaker franc. As a result, it electronically printed francs to buy euros, which were falling in value. Then in January the SNB changed its tack. Instead of buying a falling euro, it chose to buy stocks instead. Now, given 21 years in various facets of the investment world, I consider myself a savvy veteran of this world. But, I can't for the life of me figure out why any citizen of Switzerland, or any other country, would want its central bank to buy stocks.

If the SNB wants a weaker franc, should it be buying assets that go up in value or down in value? And, wouldn't it make sense to leave the stock buying game to professionals in that area? Do you really want Janet Yellen in charge of a mutual fund, or ensuring that banks have adequate capital reserves. It's just another example of why countries should restrain government (and quasi government) officials - otherwise, there will inevitably be mission creep.

Happy Trading!

The Wolf