Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

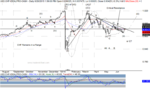

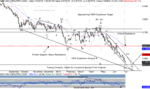

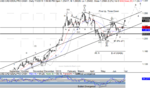

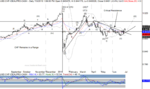

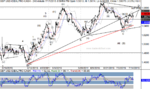

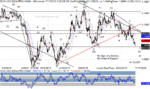

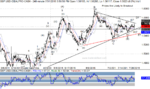

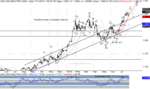

USDCHF Daily Wave Count

USDCHF is in a similar position to USDCAD. The action up from the wave (ii) low isn't a full impulse yet, although it does look like there's a clear third wave impulse internally to the rally. So, we await clarification here, although we still can't rule out a deeper wave C. If indeed we see a minor crisis develop as a result of Greece on Monday, it seems like the franc is set to suffer some c consequences rather than get a "flight to quality" bid. That would certainly be a change from the past, and potentially speaks to the absurdity of having the Swiss national bank, or any central bank own stocks.

It does seem that the world's monetary authorities have taken currency weakness to its logical extreme - buy anything with currency conjured out of thin air. However, if the intent is to grow an economy, you'd think that the geniuses running central banks would understand that buying a stock in the secondary market has NO impact on the company or economy. It simply exaggerates an existing trend. This is the reason that central banks and governments should allow private currencies; they should not be in the business of demanding by fiat that its citizens use one particular currency over any other.

Happy Trading!

The Wolf

USDCHF is in a similar position to USDCAD. The action up from the wave (ii) low isn't a full impulse yet, although it does look like there's a clear third wave impulse internally to the rally. So, we await clarification here, although we still can't rule out a deeper wave C. If indeed we see a minor crisis develop as a result of Greece on Monday, it seems like the franc is set to suffer some c consequences rather than get a "flight to quality" bid. That would certainly be a change from the past, and potentially speaks to the absurdity of having the Swiss national bank, or any central bank own stocks.

It does seem that the world's monetary authorities have taken currency weakness to its logical extreme - buy anything with currency conjured out of thin air. However, if the intent is to grow an economy, you'd think that the geniuses running central banks would understand that buying a stock in the secondary market has NO impact on the company or economy. It simply exaggerates an existing trend. This is the reason that central banks and governments should allow private currencies; they should not be in the business of demanding by fiat that its citizens use one particular currency over any other.

Happy Trading!

The Wolf