TraderTony

Active member

- Messages

- 180

- Likes

- 1

Wednesday 1st September 2004

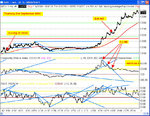

Opened gap down, closed then down again to new lows. Lacking direction ahead of 10am numbers.

10:03 Triangle breaks to the upside with TLB on CCI. Goes up to take out yesterday's high but volume looks weak. More upside soon kicks in though and ends up being strong move up - possible wave 5 carrying over from yesterday as it moves in on the recent resistance above 10200.

10:30 Fifth wave appears to have completed around 10208 (three peak ND on 5 minute chart too). This probably makes any further long entry risky now but it could still make an attempt on 10235 - the recent high.

11:11 Pulls up again after meandering sideways after wave 5 peak. Came close to 100 ema but no trade taken.

11:31 Price hits 100 ema for first time but showing no direction at the moment although horizontal TLB to downside on both RSI and CCI (quickly becoming O/S though).

11:36 TRADE ENTRY Long at 10178 on move from O/S and yesterday's high just below 100 ema (against possible 5th wave peak and recent highs above though). Soon breaks down into loss and looks like short was the way to go based on my earlier analysis. Pulled back to small profit but just formed bearish looking flag which broke swiftly to downside.

12:25 Break to upside out of channel and back above 100 ema. Needs to hold and follow through.

13:03 Sharp break to the downside and back below 100 ema - terrorism alert - great!

13:07 TRADE EXIT: Stopped out -25.

13:20 TRADE ENTRY: Short 10152 - ludicrous fill - at least 10 points off price showing following retrace to 100 ema. Seat of pants now - IB prices frozen. Market flattens out at 100 ema but with me at big big loss due to the fill.

15:20 Did eventually pull down into single digit profit but heavily oversold and bounces back up off small PD over 7 or 8 minutes. Holding for a bigger move down and proper triple PD. Might have had the best of this move already though. Stuck in congestion but stubbornly refuses to make third lower low and then bounces hard into losing position. Jeez. Up up up into the close. Shocking.

TRADE EXIT: Just before close -15

Total for day: -40 from 2

Total for month: -40

Very frustrating. Welcome back from holiday.

Opened gap down, closed then down again to new lows. Lacking direction ahead of 10am numbers.

10:03 Triangle breaks to the upside with TLB on CCI. Goes up to take out yesterday's high but volume looks weak. More upside soon kicks in though and ends up being strong move up - possible wave 5 carrying over from yesterday as it moves in on the recent resistance above 10200.

10:30 Fifth wave appears to have completed around 10208 (three peak ND on 5 minute chart too). This probably makes any further long entry risky now but it could still make an attempt on 10235 - the recent high.

11:11 Pulls up again after meandering sideways after wave 5 peak. Came close to 100 ema but no trade taken.

11:31 Price hits 100 ema for first time but showing no direction at the moment although horizontal TLB to downside on both RSI and CCI (quickly becoming O/S though).

11:36 TRADE ENTRY Long at 10178 on move from O/S and yesterday's high just below 100 ema (against possible 5th wave peak and recent highs above though). Soon breaks down into loss and looks like short was the way to go based on my earlier analysis. Pulled back to small profit but just formed bearish looking flag which broke swiftly to downside.

12:25 Break to upside out of channel and back above 100 ema. Needs to hold and follow through.

13:03 Sharp break to the downside and back below 100 ema - terrorism alert - great!

13:07 TRADE EXIT: Stopped out -25.

13:20 TRADE ENTRY: Short 10152 - ludicrous fill - at least 10 points off price showing following retrace to 100 ema. Seat of pants now - IB prices frozen. Market flattens out at 100 ema but with me at big big loss due to the fill.

15:20 Did eventually pull down into single digit profit but heavily oversold and bounces back up off small PD over 7 or 8 minutes. Holding for a bigger move down and proper triple PD. Might have had the best of this move already though. Stuck in congestion but stubbornly refuses to make third lower low and then bounces hard into losing position. Jeez. Up up up into the close. Shocking.

TRADE EXIT: Just before close -15

Total for day: -40 from 2

Total for month: -40

Very frustrating. Welcome back from holiday.