Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,206

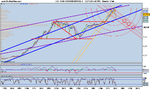

Not sure about about short $/Y other than for short termer..... we've had 3 drives down off 124 and were practically in the abyss.... be careful Atilla... I'd be more inclined to look at Euro/$ for potential opps ?? Although shorting $/Y is with the trend :cheesy:

Just a thought...........

I know what you mean HS, when it was around 116 Jacinto predicted 108 and I thought no way. But it keeps going down. I shorted at 107 and thought 106 that'll do me and it still keeps going down...

I'm tempted to stick my neck out and say it will come to a resting stop at 99... 😱

If it moves above 106.30 I'll be looking to close pos.

So far so good. Be surprised if US open raises market. But you never know as they are already talking about another .5% rate cut. Crazy 😆