black bear

Guest

- Messages

- 1,303

- Likes

- 165

That sounds like a good plan. I have stopped trading for the day - I have a gain of 21 pips on the week which makes this my worst week in 10 weeks, measured in both pips and pounds. However, stopping now gives me 10 winning weeks in a row, for the first time in my trading experience.

Well done 😀

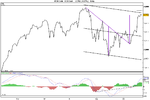

I am not great this week 24.33 points full position (do 1/3 sizes depending on set up) only do it part time mornings usually (ftse) but do like the Dow week candles, Im the idiot who shorted all the way up the bollinger bands this summer 😆 😕 then missed the big move because I had huge amounts of proper work 🙁

But it was an experience I would"nt have missed for the world.

Mrs always said I could"nt dance 🙁 But I can know :cheesy:

packing up me self top of the hour range and flatlined all day

Last edited: