You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

mark twain uk

Established member

- Messages

- 618

- Likes

- 4

Pat494 said:Yes sir its going up up up

Oh no it is isn't!

mark twain uk

Established member

- Messages

- 618

- Likes

- 4

Joules,

It was not frustration but my take on a newspaper headline. I am not sure how to interpret your statement "the economy lags the stock market", are you saying that the stock market suggests that the economy will pick up strongly in 2007? If so, I will get stopped out today or monday, I am short but not stupid, will take a hit and move on. But with 70% of the US business depending on consumer spend and with american public in debt like never before in their history there will need to be a quick rebound in the housing market to enable the public to release even more equity, at present they are spending more than they earn, this will eventually have to be solved, but I agree with you, it may take another year by which time a perpetual bear like myself would get totally wiped out.

My trade started as a scalp, I thought that yesterday's highs were high enough, if the pull back does not happen I will get out.

It was not frustration but my take on a newspaper headline. I am not sure how to interpret your statement "the economy lags the stock market", are you saying that the stock market suggests that the economy will pick up strongly in 2007? If so, I will get stopped out today or monday, I am short but not stupid, will take a hit and move on. But with 70% of the US business depending on consumer spend and with american public in debt like never before in their history there will need to be a quick rebound in the housing market to enable the public to release even more equity, at present they are spending more than they earn, this will eventually have to be solved, but I agree with you, it may take another year by which time a perpetual bear like myself would get totally wiped out.

My trade started as a scalp, I thought that yesterday's highs were high enough, if the pull back does not happen I will get out.

dc2000

Veteren member

- Messages

- 4,766

- Likes

- 129

I was dumb enough to go short yesterday

smart move not dumb at all

Why "Perpetual Bear" ....Mark

Sound like the name of the next hedge fund blow up...

Be careful ................. I've recently spent weeks salvaging a wreckless bear stance on soaring indices - when I could have been long and right like Fc and others

Edit: we are due something of a turn next week I "feel" but this is short terming - since spx often turns by day 3 or 4 of mini swing and day after expiration sometimes gives turn. Today is day 3 of mini up move.

Sound like the name of the next hedge fund blow up...

Be careful ................. I've recently spent weeks salvaging a wreckless bear stance on soaring indices - when I could have been long and right like Fc and others

Edit: we are due something of a turn next week I "feel" but this is short terming - since spx often turns by day 3 or 4 of mini swing and day after expiration sometimes gives turn. Today is day 3 of mini up move.

andycan

Established member

- Messages

- 630

- Likes

- 28

i would have to agreedc2000 said:smart move not dumb at all

follow your plan,not following it is dumb

mark twain uk said:You're too good for me, so I got stopped out and am now long again from 12090 and 1376 cash, with the tightest of stop losses. Funny psychology really, after being a bear for months and only selling the rallies, I now seem to develop a passion for buying the dips.

Saul on the road to Damascus ?

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

mark twain uk said:Oh no it is isn't!

Lets not forget we are talking about the USA basically where almost anything is possible, good sense is unwanted, fantasy and dreams are all. Who else would have elected Ronnie Reagan or George W or got Arnie in its sights for the 2012 election.

OK he's not eligible - but that's makes it all the more intriguing. He appears to be about the only politician who hasn't been hand-bagged into silence and decency by the PC brigade.

BTW The Terminator is on Telly tonight 10.55 Channel 5.

Go get 'em tough guy !

Silvertip said:Creeping closer to 12500, easy money.

Yep www.signalwatch.com identified 500 and 650..... and move starting to get a bit stretched .... ?

Great post Joules !Joules MM1 said:There are many fundamental cases for and against the current up-phase....and many technical biases, based on whether we are in a bull market phase or part of a larger degree sucker move, that will be fully retraced below mar 03......however, on a daily basis.....whether the incredibly cheap us dollar has created a long awaited, overseas, buying spree or whether the spiralling debt is a drag on what should be an even stronger bull move....who knows.... remember the whole point of bonds?....debt is a market unto itself....a complete and (still) burgeoning industry (credit cards, mortgage mysteries, corporate debt, M1 2 3 money supplies) ......none of this is an immediately relatable effect that is measurable ......sure you can give me a ratio of beta values and omega functions of economies of scale.....bubcus to context.....daily context.....intra-day context.....like arguing no longer driving your car to work to save the ozone layer....the size just doesn't fit.....yes there's a vague linkage.....economies don't turn on a dime, stock markets do......stock markets are a reflection of immediacy....economies follow.....hence when a major bear period ends the economy news may appear at its worse and cotinue to worsen as the economy and sentiment ....this is exactly the time when weak-hands let go of their positions, that they held onto for so long, as a market recovers, because their anecdotal fears tell them to exit at the best price they are likely to get.....afterall.....just look at how bad the economic news is.........anecdotal fear....not immediately relatable to the day to day activity.....even in a massive downtrend you'll have buying opportunities....fast counter-trend moves....how, exactly, would that be relatable to what's happening in the economy?......yes, I understand when you see dark clouds outside your window that's the cue to get the umbrella......but you're not going to walk around with a fully open umbrella on the off chance that rain may fall when the clouds are in the distance.....wait till they're overhead.....you've got the umbrella.....if in doubt, stay out....to gain from a short position the pattern has to be falling in a non-straddle or arbitrage play.....when you're short there's no upside to the upside.......a theory of economic viability, sustainability or fallability does not relate to the immediacy of pattern, or even lower degree trend direction and largest degree direction..... only to how much you are prepared (for) to give up, to eventually engage the umbrella when the rain does fall.......many people confuse weak-hands for people who don't have much capital versus large capital.....this is incorrect....patience, timing and capital size that is relative and in context to the price action makes the difference, not simply how much exists in an account......however it does determine the speed and extent of draw-down.....leverage is a nasty beast when you're not on the right side....J

Some food for thought, on the macro level, in terms of a potential directional change in the near future. I'm still keeping an eye out for some clear indicators before seriously considering shorting this market !

Dr John Hussman

Charles H. Dow once observed 'It is impossible to tell in advance the length of any primary movement, but the further it goes, the greater the reaction when it comes hence the more certainty of being able to trade successfully on that reaction. The best way of reading the market is from the standpoint of values. To know values is to comprehend the meaning of movements in the market.'

Hussman considers stocks to be overvalued with the S & P trading at around 18 x current earnings, and are therefore unlikely to deliver long term returns from these levels. However since investors do not currently seem to be risk averse he thinks the markets could simply move sideways for awhile.

"Among the current signs that the market is engaged in a speculative blowoff, investment advisory bullishness is running near 60%, which Investors Intelligence notes is about the level where historical bull markets have ended. As for the “smart money,” corporate insiders are aggressively liquidating stock, at a rate of about 7 shares sold for each share purchased, according to recent figures from Vickers. Meanwhile, the new issues market is booming, and low-quality stocks (on the basis of S&P's quality rankings) have for months dominated an otherwise dwindling group of market leaders. All of that said, keep in mind that even the knowledge that stocks are in a speculative blowoff isn't a very useful basis for short-term forecasts. Rather, it provides a general guidepost about the position of the market within the typical bull/bear cycle."

http://www.hussmanfunds.com/wmc/wmc061211.htm

John Maudlin is sceptical on valuations too:

"I clearly don't get it. I simply don't see the risk versus reward of the broad stock market at these levels, with all the warning signs we can see today. To argue for higher market levels, as almost every economist is (Barron's in their recent roundtable forecast had not even one bearish participant), is to believe that this time it's different. It almost never is. I admit to the possibility. But I find it hard to risk capital in long-only stock investments, my own or clients', in what looks and feels like 1999."

Charlie Miller

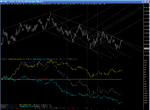

"The talking heads on TV seem to be drowning in exuberance, over "New Highs for the Dow," and a sage Guru with knowing eye pointed out the "... rising price on huge volume, and you know what THAT means!" Sure enough, when we look at the daily bar charts, this IS a market that seems destined to outpace the hot market of the late 1990's. Just throw your money at ANYTHING, and become a cocktail party guru. Can't blame the TV people for talking about the obvious now, can we? Well, never let it be said that I'm afraid to be contrarian.

It's when we look at the intraday charts that we see evidence of those unnatural forces. A snap of the whip at the open, and the Dow sets a new historic high. The market horse may seem to respond to the "request for more impulsion," but it gets tired very quickly. Today's excess, and yesterday's loner spike represent, I believe, "the snapping of the buggy whip," either by the PPT, or by the major cyborgs, who normally would be snapping the whip in the downward direction. Ben and Henry have gone out for Chinese, but I'm sure that they have left strict orders for the children they've left "Home Alone." If this is their work, there's a negative implication for the Ist quarter, to 1st half of 2007. If it's the major cyborgs, then there's perhaps a more serious, shorter term negative implication, but one that can be controlled (by the Fed).

We have hit the next pivot point following another cyclic flip. Notice that I've placed a gray down arrow on the chart for next week. It probably should be red, but considering the amount of manipulation I see in the above charts, I refuse to be overconfident."

Dr John Hussman

Charles H. Dow once observed 'It is impossible to tell in advance the length of any primary movement, but the further it goes, the greater the reaction when it comes hence the more certainty of being able to trade successfully on that reaction. The best way of reading the market is from the standpoint of values. To know values is to comprehend the meaning of movements in the market.'

Hussman considers stocks to be overvalued with the S & P trading at around 18 x current earnings, and are therefore unlikely to deliver long term returns from these levels. However since investors do not currently seem to be risk averse he thinks the markets could simply move sideways for awhile.

"Among the current signs that the market is engaged in a speculative blowoff, investment advisory bullishness is running near 60%, which Investors Intelligence notes is about the level where historical bull markets have ended. As for the “smart money,” corporate insiders are aggressively liquidating stock, at a rate of about 7 shares sold for each share purchased, according to recent figures from Vickers. Meanwhile, the new issues market is booming, and low-quality stocks (on the basis of S&P's quality rankings) have for months dominated an otherwise dwindling group of market leaders. All of that said, keep in mind that even the knowledge that stocks are in a speculative blowoff isn't a very useful basis for short-term forecasts. Rather, it provides a general guidepost about the position of the market within the typical bull/bear cycle."

http://www.hussmanfunds.com/wmc/wmc061211.htm

John Maudlin is sceptical on valuations too:

"I clearly don't get it. I simply don't see the risk versus reward of the broad stock market at these levels, with all the warning signs we can see today. To argue for higher market levels, as almost every economist is (Barron's in their recent roundtable forecast had not even one bearish participant), is to believe that this time it's different. It almost never is. I admit to the possibility. But I find it hard to risk capital in long-only stock investments, my own or clients', in what looks and feels like 1999."

Charlie Miller

"The talking heads on TV seem to be drowning in exuberance, over "New Highs for the Dow," and a sage Guru with knowing eye pointed out the "... rising price on huge volume, and you know what THAT means!" Sure enough, when we look at the daily bar charts, this IS a market that seems destined to outpace the hot market of the late 1990's. Just throw your money at ANYTHING, and become a cocktail party guru. Can't blame the TV people for talking about the obvious now, can we? Well, never let it be said that I'm afraid to be contrarian.

It's when we look at the intraday charts that we see evidence of those unnatural forces. A snap of the whip at the open, and the Dow sets a new historic high. The market horse may seem to respond to the "request for more impulsion," but it gets tired very quickly. Today's excess, and yesterday's loner spike represent, I believe, "the snapping of the buggy whip," either by the PPT, or by the major cyborgs, who normally would be snapping the whip in the downward direction. Ben and Henry have gone out for Chinese, but I'm sure that they have left strict orders for the children they've left "Home Alone." If this is their work, there's a negative implication for the Ist quarter, to 1st half of 2007. If it's the major cyborgs, then there's perhaps a more serious, shorter term negative implication, but one that can be controlled (by the Fed).

One other implication derives from asking "But, why primarily the Dow, and not equally the COMPX and the S&P?" Here we come back to the hapless TV coverage. Their primary coverage of floor operations comes from the NYSE, logically because that's where people are "on a floor." People make TV interesting. If there's hype, intentional or otherwise, that then is where most of it will come from. Unfortunately, they are caught in a catch-22, merely by reporting the facts as they develop. Fortunately, for those who will listen, a few cooler heads will at least indicate that they are guardedly skeptical. I believe that they guard as well as they possibly can, against being exploited. I BELIEVE THAT YOU SHOULD BE SKEPTICAL, AS WELL.

We have hit the next pivot point following another cyclic flip. Notice that I've placed a gray down arrow on the chart for next week. It probably should be red, but considering the amount of manipulation I see in the above charts, I refuse to be overconfident."

Last edited:

Well its a good job there's a plethora of views to keep the markets going - an article in this weeks IC firstly states that the cash flow yield on US equities is close to a 16 year high brought about mostly by share buy backs - and secondly it goes on to state that at the current buy back rate of $545.9bn per annum, equivalent to 5% of the market, means that the US stock market wil disappear in 20 years time! What will we do then?

dc2000 said:Always wiv da negative waves 😆

with Friday giving exactly what was expected, Mark 😉 I have no reason to change the plan going forward take the entry and look for 250 points then finish for the week and the year

are implying 250 points up or 250 points down ?

H

Similar threads

- Replies

- 3

- Views

- 2K