dr.blix

Senior member

- Messages

- 2,279

- Likes

- 33

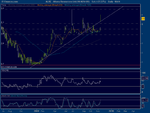

i just had to post this chart, as i love these bizarre little events.

i set this trend line for altona resources last week, after re-reading a simple TA book that talked about taking trend lines, S+R levels from as far back in the company's history as possible.

so i drew this line due to the relevance on jan 12, jan 21, feb 25, aug 11, oct 12 levels.

also i liked the way it held parity with my 125MA.

after its joint venture news release, this is where it opened.

just a coincidence i know. but i do enjoy them non the less.

i set this trend line for altona resources last week, after re-reading a simple TA book that talked about taking trend lines, S+R levels from as far back in the company's history as possible.

so i drew this line due to the relevance on jan 12, jan 21, feb 25, aug 11, oct 12 levels.

also i liked the way it held parity with my 125MA.

after its joint venture news release, this is where it opened.

just a coincidence i know. but i do enjoy them non the less.