First of all let me also thank Mr M for encouraging us all to think for ourselves, this is what its all about...at last a debate that can go somewhere if it can stay on track! Ive been doing plenty of thinking, geez I was at work at 8am this morning, just got home (11.45pm) and will now stay up to record some more observations, pass the coffee please 😱 A few more weeks and Ill be booking into the Priory with all the big brother numpties.

Anyway if its ok with firewalker et all may I participate with my two pence worth (hope im not miles of base, but hey, its all a learning curve!

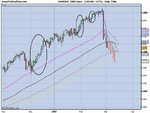

Right for the past few weeks the market (DAX in this case) has been struggling to muster up any real strong demand. In fact the last 2 weeks appear to have been moving up on weak shorters closing their positions, just nudging the market slightly higher each time. Then on the 20th feb we had a bit of action to the downside which was bought back up quickly. The next day had even more action down, this to me showed a sign of possible things to come (maybe a baby swan lost down stream?)

The market is marked up on the 22nd but yet again no real demand apparent, also couldnt hold the highs! Long holders at this point should at least be a bit cautious, especially with the possibility that mother swan maybe tring to find her baby 😆

Gap up again on the 26th to 4/5 year highs and yet again no real buying, alarm bells... especially with the US having been down for the last 3 days!

Ok the market falls pretty hard (not saying crash or anything like that) taking out loads of stops on the way down, but baring in mind the move over the last 3 months there were alot of weak hands in the market on the way up from various levels so this depth of fall isnt out of this world!

If the pros hadnt taken profits before, then they must have liquidated a chunk on the way down adding to the speed of the move.

Now at the end of this exciting day,we can see that there was not a decent bounce all session and if we dont get one straight away the next morning then this tells me something about open positions in the market. Also baring in mind the action for the day, if weak hands werent willing to buy before, then surely they arent now. But hopefully we will get a idea the next day. Ok, on the 28th we opened up, pros making sure that they profited from sell positions, but from then on the market pretty much dies off. This must be a strong sign that weak hands were only SELLING TO CLOSE on the 27th, not to iniciate NEW OPEN POSITIONS to the short side. Had they opened to the sell side then they would have been late shoters and going by the volume at lot of them. Thus when the markets opened up the next day they would have been force to BUY TO CLOSE which would have caused massive velocity to the upside which would have encouraged weak hands to buy thus creating even more speed upwards!

As we can see this didnt happen the Dax made its way upto 6790 (march) and fell down again.

So....for pros looking to re-accumulate they need weak hands on the short side, and this has yet to be achieved. It doesnt mean that there will be no more buying from this point, indeed any weak buyers can be exposed to the downside creating the action that will entice new open short positions that the pros can take advantage of.

Maybe something a bit like the image below. So, the market may still have further to go down, but I dont belive its anywhere near as bad as many on these boards are making out. I guess the baby swan will find its mother without her getting too anoyed....at least for now 😈

I hope this post isnt too long and boring for you all. I just wanted to have a go as i dont post that often.

Mark if im way off base please be gentle, give me a mark out of 100, its will sound better that out of 10, unless its 1, or 2 then it will be s**t, and of to the Priory I will go with my Kylie Minogue CD 😎

BTW hope you are better soon, and thanks for all these thought provoking sessions. Must go got a head ache now, its tooooo late.

Regards D S